What is turnover?

In simple terms, turnover is the sum of all income for goods, products or services of a company. To calculate turnover, the sum of all revenues is added together. To calculate profit, all costs or expenses can be deducted from turnover. Turnover is therefore an accounting concept that calculates how quickly a company conducts its business. Turnover is calculated by adding together existing receivables and invoices issued to customers. A receivable is a creditor’s claim to a payment (usually financial) from a debtor.

Sales ratios are used to calculate how quickly a company generates cash from its receivables and inventories. These ratios can be used by asset managers and investors in fundamental analyses, for example, to determine whether a company is a good investment. Such sales ratios are, for example, return on sales or return on sales.

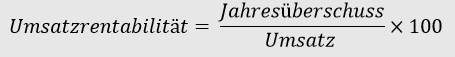

Formula for return on sales

This key figure puts turnover in relation to profit. It therefore shows what percentage of profit is left over per franc of turnover generated. A rising return on sales, with the price of the company’s product or service remaining unchanged, therefore shows an increase in the company’s productivity.

Examples of other key sales figures

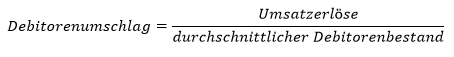

Accounts receivable turnover

The company ‘s liquidity can be assessed using the accounts receivable turnover. The accounts receivable turnover indicates how often the accounts receivable balance is included in the sales revenue.

The accounts receivable turnover formula provides information on how quickly a company collects payments compared to credit sales. The aim is to maximize sales, minimize the receivables balance or accounts receivable and achieve a high turnover rate.

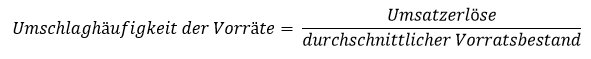

Inventory turnover rate

The average storage time in days can be calculated using the inventory turnover rate. The higher the inventory turnover rate, the shorter the average storage time. In other words, the inventory turnover rate indicates how often the stock is consumed or sold. The formula for the inventory turnover rate is as follows:

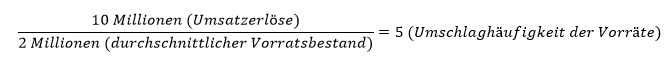

Let’s assume that company X has an average inventory of CHF 5 million and generated sales of CHF 10 million in 2020. The inventory turnover rate in this example is 2, which means that the company turns over its inventories twice a year.

Company Y has an average inventory of CHF 2 million and also generated sales of CHF 10 million in 2020. The inventory turnover rate in this example is 5. Company X is therefore considered less profitable than company Y, as company Y can generate the same turnover with a smaller average inventory.