Enterprise Valuation

Would you like to invest your money? Get in touch with an expert:

What is Enterprise Valuation?

Enterprise valuation refers to the process of determining the economic value of a company. Valuing a company can be done for its entire organization or for parts of that organization (business units). The evaluation of a company may be necessary, for example, in the event of its sale or merger with another organization. Tax reporting requires valuation as well. A professional consultant is often engaged to conduct valuations.

Various methods are available for valuing companies. There are a number of factors that can be taken into account when valuing a business. These include for example the company's management, or its capital structure. Depending on the company and industry, valuation tools can vary. Enterprise valuation approaches include auditing financial statements, discounting cash flow models, and comparing similar companies.

Enterprise Valuation Methods

Enterprise valuation isn't an exact science, but it's very complex. There are a lot of ways to value a company. Here are a few examples:

Market Capitalization

One of the simplest methods is to use market capitalization. The market capitalization of a company is calculated by multiplying the share price by the number of outstanding shares. The market capitalization of Bell AG, for instance, is 1.76 billion Swiss francs. There are 6.28 million shares (as of February 21th 2022), and the price is CHF 280. A company's market capitalization is therefore its stock exchange valuation.

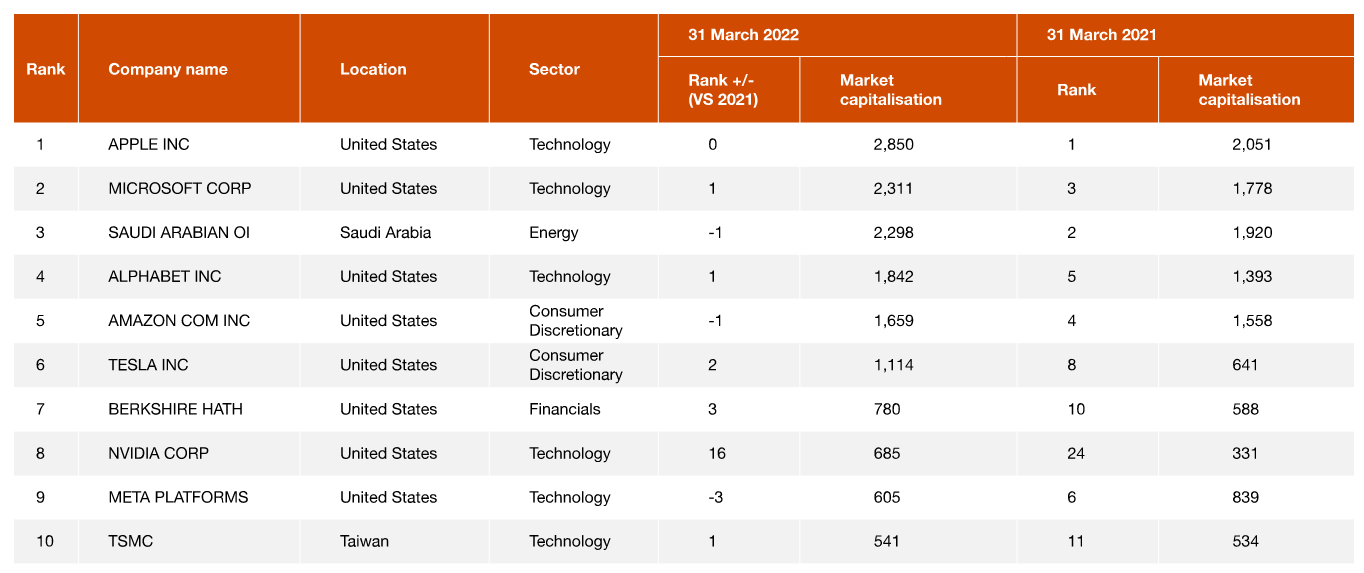

The company with the highest market capitalization (as of 03/31/2022) is Apple, followed by Microsoft and Saudi Aramco.

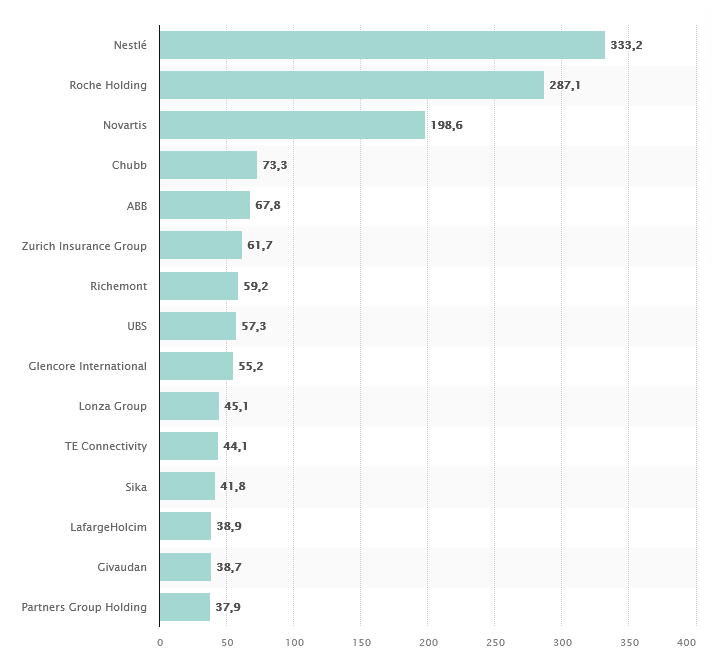

The largest Swiss company (as of April 16, 2021) is Nestlé with a market capitalisation of $333.2 billion, followed by Roche and Novartis.

The 15 Largest Swiss companies by Market Capitalisation (as of April 16, 2021), in Billions of USD

Source: www.statista.com

Market Value Methods - the Use of Multipliers

Listed companies can be valued using so-called multiples. Stock exchange prices (trading multiples) are a good example. Sales, EBITDA, EBIT, net income, and price/earnings ratios are further examples of multiples. With the enterprise valuation method based on the sales factor (Times-Revenue Method), a sales stream generated over a specified period of time is assigned a multiple based on the industry and the economic environment. A technology company, for instance, can be valued at three times its sales, while a service company can be valued at half its sales.

Enterprise Value = Sales – Sales Multiplier

As an alternative to the sales multiple, the profit multiple can also be used to determine the actual value of an organization, as profits are a more reliable indicator of financial success than sales (revenues). There are several different profit multiples that can be used:

Enterprise Value = EBITDA x EBITDA Multiplier

Enterprise Value = EBIT x EBIT Multiplier

Enterprise Value = Net profit x Net profit Multiplier

where:

EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization

EBIT= Earnings Before Interest and Taxes

Discounted Cash Flow (DCF)-Method

The discounted cash flow method calculates a company's fair value based on future cash flows. An investor's expected cash flows over the investment's duration T are added to the terminal value of the investment. As a basis for valuation, free cash flow is used. Free cash flow refers to the cash flow that is available for distribution without affecting the company's existing plans. The cash flows are discounted using a tax-adjusted weighted average cost of capital (WACC). For more information on the formula and specific examples of Discounted Cash Flow (DCF), please refer to Discounted Cash Flow (DCF).

Economic Value Added (EVA)-Method

Economic value added (EVA) is an indicator of the financial performance of a company. Since EVA tries to capture the true economic profit of a company, it's also called economic profit. EVA is the difference between the rate of return (RoR) and the cost of capital for a company. An EVA of a company that is negative indicates that the company is not creating value with the funds it has invested.

EVA = NOPAT - (Invested Capital x WACC)

where:

NOPAT: Net Operating Profit After Taxes.

Invested Capital: Debt + Capital Leases + Shareholders' Equity

WACC: Weighted Average Cost of Capital

EVA aims to calculate the cost of investing capital in a business and determines whether it generates enough cash to be considered a worthwhile investment. EVAs that are positive indicate that a project is generating returns that exceed the minimum requirement.

The present value of future EVAs is the first step in determining the value of an EVA-based enterprise valuation. Enterprise value is determined by adding the capital invested at the beginning of the period and the terminal value to the present value of future EVA. In theory, DCF and EVA should produce the same results.

Book Value

The book value of a company is the value of its equity as reported on its

balance sheet. It is calculated by subtracting a company's total liabilities (current and non-current liabilities) from its total assets.

Liquidation Value

In general, liquidation value refers to the present value of a company's assets if its assets were liquidated and its liabilities repaid today.

Many More Methods

This is not a comprehensive list of the different business valuation methods in use today. There are many other valuation methods available, including replacement value, breakup value, asset-based approach, and many more.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.