Inflation

Would you like to invest your money? Get in touch with an expert:

What is Inflation?

The rate at which the purchasing power of a currency declines over time is known as inflation. The average price level of selected goods and services in an economy over a period of time can be used as a quantitative indicator of the rate at which purchasing power decreases. One Swiss franc can buy less than in previous periods because of the increase in the general price level, often expressed as a percentage. Deflation is the opposite of inflation, which refers to a decrease in prices and an increase in the purchasing power of money.

More about Inflation

While it is possible to measure the price changes of individual products over time, the needs of humans extend far beyond one or two products. To live comfortably, humans require a wide range of products and services. Food, metals, and fuel fall into these categories, as do utilities such as electricity and transportation, as well as services such as health care, entertainment, and labor. The objective of inflation is to measure the overall effect of price changes on a wide range of goods and services in an economy over a period of time, and to represent the increase in the price level for goods and services over this period as a single number.

The loss of value of a currency results in higher prices and fewer opportunities to purchase goods and services. Economic growth is slowed due to the loss of purchasing power, which ultimately leads to a rise in living costs. Economists generally agree that persistent inflation occurs when a country's money supply grows faster than its economic growth. In order to prevent this, the Swiss National Bank (SNB), for example, controls the supply of money and credit to keep inflation within acceptable limits and to maintain the economy.

An economic theory known as monetary theory explains how inflation and money supply are related. For example, in the aftermath of the conquest by the Spanish of the Aztec and Inca empires, massive amounts of gold and particularly silver were imported into the Spanish and other European economies. With the rapid growth of the money supply, the value of money declined, resulting in rapidly rising prices.

Inflation is measured in different ways based on the type of goods and services being considered. It is the opposite of

deflation, when inflation falls below 0%, which indicates a general decline in prices.

Causes of Inflation

Inflation is primarily caused by an increase in the money supply, which can be triggered by a variety of economic factors. It is possible for monetary authorities to increase the money supply by printing more money and issuing it to citizens, devaluing legal tender, or (most commonly) by purchasing government bonds from banks in the secondary market as reserve account balances through the banking system. Whenever the money supply expands, the purchasing power of the currency decreases. Three types of inflation can be distinguished: demand-side inflation (demand-pull), cost-side inflation (cost-push), and built-in inflation (built-in).

Demand-Pull Effect (Demand-Side Inflation Effect)

Demand-pull inflation occurs when the supply of money and credit increases faster than the economy's productive capacity. When consumers have more money at their disposal, they are more likely to spend, and this increased demand leads to higher prices. With higher demand and less flexible supply, a demand-supply gap is created, resulting in higher prices.

Cost Push Effect (Cost-Side Inflation Effect)

Cost-push inflation is an increase in prices caused by an increase in the means of production. The cost of all types of intermediate goods increases when additional funds and credit flow into commodity or other goods markets, particularly when the flow is accompanied by a negative economic shock to the supply of the main commodity. These developments result in higher costs for finished goods and services, which are reflected in increased consumer prices. Example: A speculative boom in oil prices, due to an expansion of the money supply, may cause the cost of energy to rise and contribute to higher consumer prices.

Built-In Effect (Built-In Inflation)

The concept of built-in inflation is associated with adjustable expectations. It is likely that individuals will expect interest rates to remain at their current level, which implies that prices are steadily rising. The rise in prices of goods and services leads workers to expect that the prices will continue to rise at a similar rate in the future and to demand higher wages in order to maintain their standard of living. This wage-price spiral is perpetuated as one factor induces the other.

How Inflation is Measured in Switzerland

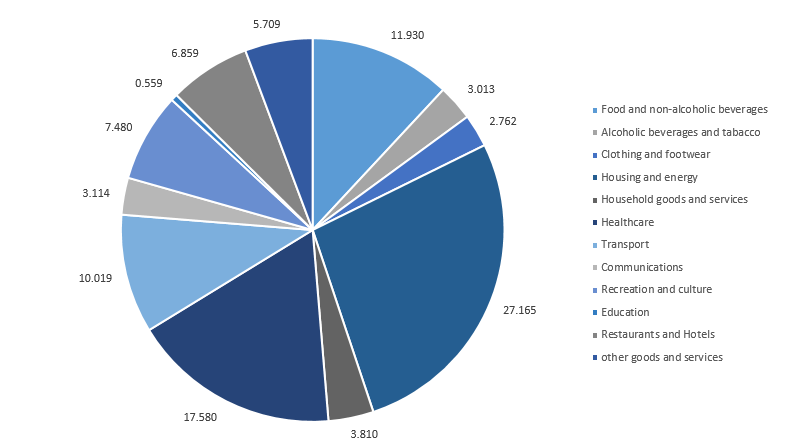

In Switzerland, price trends are calculated using the so-called national consumer price index (CPI). For example, in 2021 the basket looked as follows:

Consumer Price Index (CPI): Basket and Weights 2021

Source: Based on FSO-Consumer Price Index (CPI) 2021

According to the Federal Statistical Office (FSO), the CPI is calculated based on a basket of goods. These twelve most important expenditure categories are weighted according to their importance and should include the most important expenditures of households. By comparing prices at different points in time to prices at the base point, it is possible to determine how much the prices of these goods and services have risen, for example, within a year. A rise in the Consumer Price Index is referred to as inflation, meaning that one Swiss franc will be able to buy fewer goods and services. As a result, purchasing power has decreased. In the event that it has fallen, you are experiencing deflation, and you will receive more goods and services with a Swiss franc than you did a year ago. There has been an increase in purchasing power.

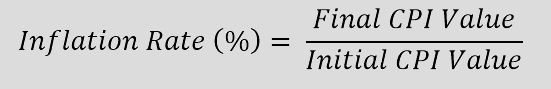

The Formula for Calculating Inflation

It is possible to calculate the value of inflation between two specific months (or years) using the price index mentioned above. Mathematically, this calculation is very simple and looks like follows:

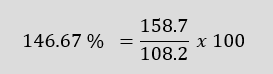

For example, according to the Federal Statistical Office, the CPI was 108.2 in 1986 and 158.7 in 2020. Thus, the percentage inflation rate from 1986 to 2020 was:

This corresponds to an annual growth rate of inflation of about 1.13% per year over the period of 34 years.

Advantages and Disadvantages of Inflation

Inflation can be seen as a positive or a negative phenomenon, depending on your viewpoint.

Some people who own tangible assets that are priced in a currency, such as real estate or inventory, may be happy about inflation because it increases the value of their assets. Inflation, however, may not be welcomed by the buyers of such assets since they are required to spend more. Another popular way for investors to profit from inflation is through inflation-indexed bonds. Those who own currency-denominated assets, such as cash or bonds, also dislike inflation since it erodes the real value of their investments. Gold, commodities, and real estate investments are inflation-protected asset classes that investors should consider if they wish to protect their portfolios from inflation.

The inflation rate encourages companies and individuals to speculate on risky projects, as they expect a higher return than inflation. To some extent, an optimal level of inflation encourages spending rather than saving. Over time, if the purchasing power of money declines, there may be a greater incentive to spend money today rather than to save it. In turn, this can increase spending, which is beneficial to the economy of a country. A balanced increase is believed to keep inflation within an optimal and desirable range.

A high and widely fluctuating inflation rate can have a significant impact on an economy's financial position. Buying, selling, and planning decisions of businesses, workers, and consumers must take into account the impact of generally rising prices. As a result, the economy faces an additional source of uncertainty, since future inflation rates may be misjudged. Researching economic behavior based on expected increases in general prices rather than real economic fundamentals inevitably represents a cost to the economy.

It is important to note that even a low, stable, and easily predictable rate of inflation, which is considered by some to be optimal, may result in serious problems in the economy due to how, where, and when new money enters the economy. Whenever new money or credit is introduced to the economy, individuals or businesses may receive it. As the new money is spent the process of adjusting the price level to the new money supply begins. In this process, it first increases the prices of individual items, and then increases the prices of others. The sequential change in purchasing power and prices resulting from inflation not only causes an increase in overall prices, but also produces distortions in wages, rates of return, and relative prices. According to economists, distortions of relative prices that diverge from the economic equilibrium are detrimental to the economy.

How to Control Inflation

A country's or an economic area's central bank has the important responsibility of controlling inflation. A central bank determines the size of the money supply and its growth rate through monetary policy measures.

Price stability is a primary objective of the Swiss National Bank's monetary policy. As a result of price stability, or a relatively constant level of inflation, companies are able to plan for the future because they know what to expect. In the opinion of the SNB, this is an essential prerequisite for growth and prosperity.

The SNB can also take extraordinary measures in extreme conditions, such as the introduction of a minimum exchange rate of CHF 1.20 per euro after the financial crisis from September 2011 to January 2015, the introduction of negative interest rates from June 1972 to November 1979, and again from November 2014 until 2022. The central banks of other countries have also taken extraordinary measures in the past. Following the 2008 financial crisis, the Federal Reserve kept interest rates near zero and implemented a bond-buying program known as quantitative easing. While some critics claimed that the program would result in a surge in U.S. dollar inflation, inflation peaked in 2007 and declined steadily thereafter. There are many complex reasons why quantitative easing did not result in inflation or hyperinflation, but the simplest explanation is that the recession in itself was a very pronounced deflationary environment, which was supported by quantitative easing.

As a result of the financial crisis (2007-2008), the Federal Reserve and the European Central Bank implemented aggressive quantitative easing measures to counter deflation in the Euro-zone, and negative interest rates were imposed in some areas due to the fears of deflation causing economic stagnation. It is also important to note that countries in which growth rates are higher are capable of tolerating higher inflation rates. Approximately 4% is the target for India, while 4.25% is the target for Brazil.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.