What is Berkshire Hathaway?

Berkshire Hathaway is a holding company (not an operational financial holding company) for a large number of companies. The company also holds significant minority stakes in listed companies such as Apple. It is led by Chairman and CEOWarren Buffett. Berkshire Hathaway is headquartered in Omaha, Nebraska and was originally a company consisting of a group of textile mills. Due to competition from Asia, the company was not doing very well, whereupon Warren Buffett bought holdings in other sectors.

Berkshire Hathaway’s own companies

Source: www.aktienmitkopf.de

The insurance subsidiaries typically make up the largest part of Berkshire Hathaway, but the company also manages hundreds of different companies around the world, including Duracell, International Dairy Queen, Pampered Chef, Fruit of the Loom, NetJets and GEICO, to name just a few. In addition to owning private companies, Berkshire Hathaway also has a large investmentportfolio of shares in major listed companies (see illustration). Buffet is particularly fond of investing in the insurance business. Around 28% of revenue was earned from the insurance business in 2020. In the manufacturing sector, the company earned around 24% of sales in 2020.

In 1982, the company merged with Blue Chip Stamps (an investment and discount stamp company). As a result of the merger, Charlie Munger became Vice Chairman of the company. To this day, Warren Buffett and Charlie Munger are not only joint chairmen of Berkshire Hathaway, but also good friends who have inspired each other with theirvalueinvesting style. Despite their advanced age, Warren Buffett (born 1930) and Charlie Munger (born 1924) also chair Berkshire Hathaway’s 2022 Annual General Meeting, where they spend hours answering questions from investors.

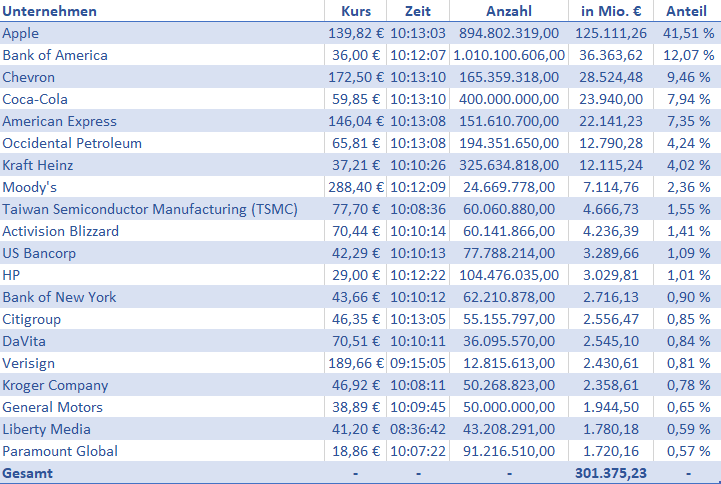

Berkshire Hathaway’s largest holdings

Source: www.boerse.de, as at November 2022

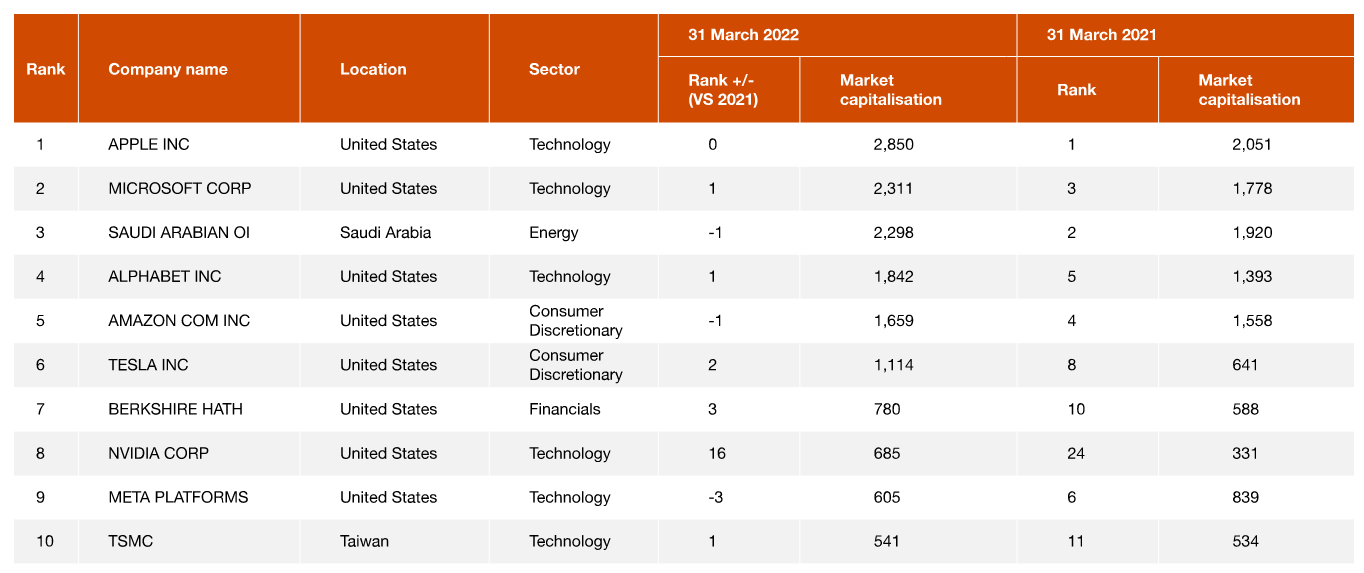

Berkshire Hathaway has a market capitalization of approximately $780 billion , making it one of the largest publicly traded companies in the world. Due to Berkshire Hathaway’s long history of operational success and its committed investments, the company has risen to become the seventh largest listed company in the world by market capitalization (as of March 31, 2022).

List of the 10 most valuable companies by market capitalization

Source: www.pwc.de

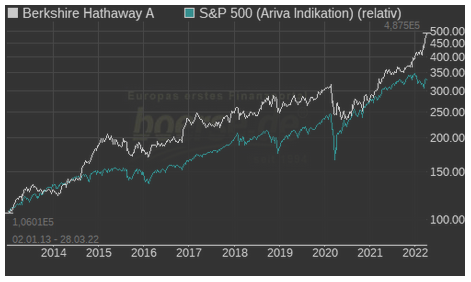

Berkshire’s shares are traded on the New York Stock Exchange in two classes: A shares and B shares. Berkshire Hathaway Inc. Class A shares currently trade for USD 472,257 (as of February 21, 2022). Berkshire Hathaway Inc. class B shares are traded for USD 314.80 (as at: 21/02/2022). From 1965 to 2019, the annual performance of Berkshire Hathaway shares was more than double that of the S&P 500 Index. The share achieved an annual gain of 20 % during this period, while the S&P 500 Index achieved an annual gain of 10.2 %.

Comparison Berkshire Hathaway A vs. SP 500

Source: www.boerse.de