Bonds

Would you like to invest your money? Get in touch with an expert:

What is a Bond?

A Bond is a loan from a lender (investor) to a borrower (usually a company or government). The Bond is a fixed-interest financial instrument. Debtors, or borrowers, are the owners of bonds. Alternatively, they are referred to as the issuer. An investor in a bond is by definition a lender. Thus, a bond is a way for an investor (lender) to lend money to a company, for example, by buying a bond from the company. The investor receives interest, which is also referred to as a coupon rate or bond interest. The principal of the loan must be repaid to the owner of the bond (lender) after a predetermined period of time.

There are several features common to most bonds, including the par value, which represents the amount due at the end of the term. An issuer (borrower) of a bond will pay a coupon rate on the face value of the bond. An interest rate is determined primarily by the quality of credit and the maturity of the debt. In order to compensate the lender (investor) for the risk of default, an issuer with a poor credit rating must pay a higher interest rate. There's also a tendency for very long-maturity bonds to pay more interest. Bonds have coupon dates when they pay interest. When the bond matures (maturity date), the issuer (borrower) pays the lender (investor) its face value. The issue price is the price at which the bond was originally sold by the issuer. Bonds typically bear interest rate risks, spread risks, credit risks, liquidity risks, currency risks, inflation risks, and early termination risks.

Bonds are classified as fixed-income instruments due to the fact that they typically pay debtors a fixed rate of interest (coupon). It is now common to find variable or floating interest rates as well. In this regard, bonds provide a solution by enabling a number of individual investors to play the role of lenders. It is also possible to trade bonds. As a result, an investor is not required to hold a bond until its maturity date. Bonds are also commonly repurchased by debtors when interest rates fall or their credit rating improves so that they are able to issue new bonds at a lower price.

The Issuers of Bonds

Bonds are typically issued by governments and corporations. Bonds are issued as a means of borrowing funds.

Bonds issued by governments are referred to as government bonds. As an example, the funds are required to finance roads, schools, and other infrastructure.

Corporate bonds are issued by companies for the purpose of investing in their business. The average bank cannot provide the amount of money needed by companies to accomplish this.

Types of Bonds

Bonds can be issued in different forms. There is therefore a wide variety of bonds available to investors. Different types of bonds may be differentiated based on the interest rate or type of coupon payment, may be redeemed by the issuer, or may have other characteristics.

Priority: Senior bonds and Subordinated Bonds

When a company declares bankruptcy, senior bonds receive priority; however, subordinated bonds are only considered after all other outstanding bonds have been repaid. Due to this, subordinated bonds are associated with higher risks and returns than senior bonds.

Securitized Rights or Bonds with Option

e.g., convertible bonds, callable and puttable bonds

An option is provided with these bonds. The convertible bond contains either a conversion right or an obligation to convert. Thus, a convertible bond entitles the holder to convert it into shares within a defined period of time. Mandatory convertible bonds are variations of normal convertible bonds. CoCo bonds are one example. Upon the occurrence of a predefined event, this bond is automatically converted into equity. A callable bond can be called back by the company (borrower) before maturity. In the case of a puttable bond, bondholders have the option of returning or selling the bond to the company before it reaches maturity.

Currency of Issue and Place of Issue

e.g., hybrid bonds

This is a bond where the deposit and the current interest payment are made in a different currency than the repayment. There are also domestic bonds and foreign bonds.

Interest Rate Structure and Maturity

e.g., Straight Bonds

A straight bond, for example, is a fixed-rate bond whose interest rate is fixed throughout its term. The term floater refers to a bond with a variable interest rate. Zero-coupon bonds are bonds in which no regular interest is paid. Consequently, the investor is compensated by the difference between the issue price and redemption price.

Interest Rate Risk of Bonds

Bonds are subject to interest rate risk. Thus, bond prices are affected by changes in interest rates. A bond becomes more attractive if the interest rate falls. It is likely that the price of the bond would rise in response to a fall in interest rates, as investors would bid up the price until it trades at a premium that reflects the prevailing interest rate environment. As a result, the bond would no longer trade at par (100%), but rather above par. In this situation, the yield on the bond is less than the nominal interest rate. This is due to the fact that the buyer has paid more for the bond than the nominal value he will receive at maturity. Therefore, it is true that the price of a bond is inversely related to interest rates. The bond price falls as interest rates rise, bringing the bond's interest rate into line with current interest rates, and vice versa. Interest rate risk refers to this effect.

The Valuation of Bonds

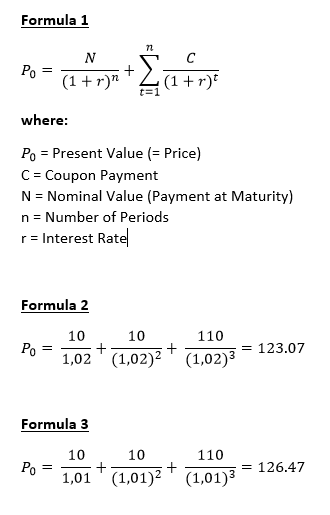

When buying a bond, the investor benefits from interest and also from price increases. Bonds do not have to be held until maturity. Bondholders may sell their bonds on the open market at any time. In most cases, the price is expressed as a percentage of the respective nominal value. A price of 110.25 indicates that a buyer must pay 110.25% of the bond's nominal value at the time of purchase. Bonds are valued based on the present value of all future payments (formula 1).

Assume a bond has a maturity of 3 years. There is a nominal value of CHF 100 and a coupon of 10%. The issue was made at par (=100%). The present value can now be determined. The risk-free market interest rate is used as the interest rate. Assume that the risk-free market interest rate is currently 2%. The calculation is shown in formula 2.

Consider a scenario in which the risk-free market interest rate drops to 1% after the bond is purchased. As a result, the bond's present value increases. The calculation is shown in formula 3.

Yield to Maturity (YTM)

An alternative way to look at the price of a bond is to evaluate its yield to maturity (YTM). The YTM represents the expected total return on a bond if it is held to maturity. The yield to maturity is expressed as an annual rate and is considered to be a long-term bond yield.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.