Profit (Accounting)

Would you like to invest your money? Get in touch with an expert:

What is Profit?

Profit has many definitions. Accounting profit is defined as the excess of income from a business activity over expenses, costs, and taxes. Businesses may either distribute profits to their owners or invest them in the business. Profit is calculated by subtracting total expenses from total revenues. A negative profit is referred to as a loss.

A company's

gross operating profit, operating profit (Earnings before interest and taxes (EBIT)), and

net profit are the three most important types of profit. An income statement contains information regarding these types of profits.

The Calculation of Profit

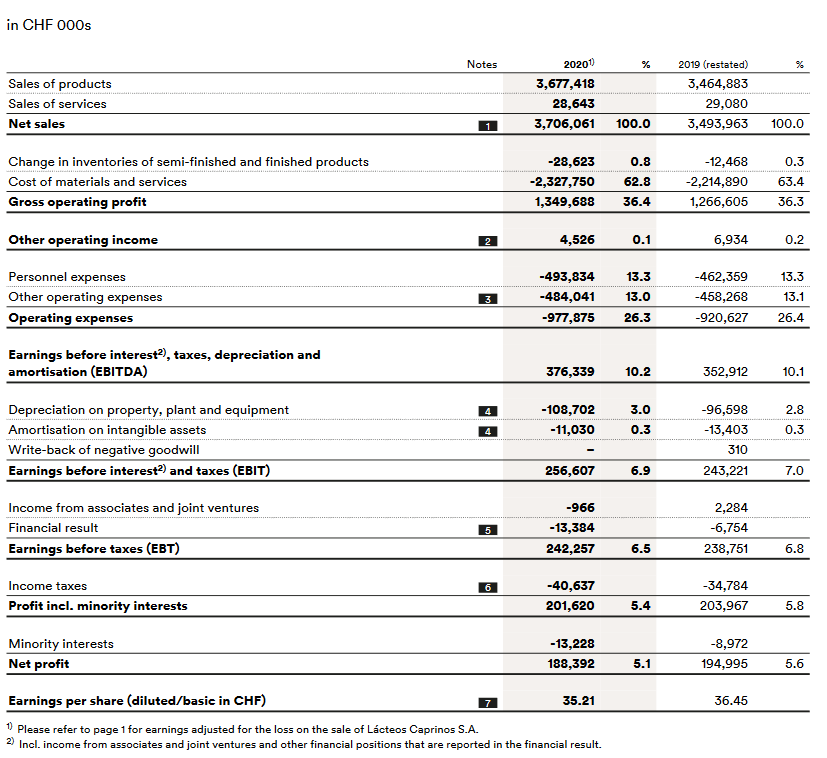

Gross operating profit is calculated by subtracting all costs associated with a product or service from its sales. Sales are usually the first item on the income statement, followed by cost of goods sold (COGS). The figure below illustrates the consolidated income statement of the Emmi Group in 2020. In 2020, the Emmi Group achieved a gross profit of TCHF 1,349,688.

Gross Operating Profit = Net Sales - COGS

A company's

operating profit (earnings before interest and taxes (EBIT))

is calculated by deducting its operating expenses, depreciations and amortizations from its gross operating profit. Distribution, administrative, and general costs are examples of operating costs. In 2020, the Emmi Group achieved TCHF 256,607 in operating profit before interest and taxes (EBIT). The operating profit margin can be calculated by dividing total sales by the operating result.

EBIT = Gross Operating Profit – Operating Expenses – Depreciation and Amortization

EBIT Margin = (Net Sales / EBIT)

A net profit is the profit remaining after all expenses have been paid, including interest and taxes. In 2020, the Emmi Group generated a net profit of CHFT 188,392.

Net Profit = EBIT – Interest Expense - Taxes

Source: Consolidated Income Statement Emmi Group 2020, www.group.emmi.com

Profit in Cost Accounting

Profits reported in the income statement are not really meaningful due to legal requirements and accounting policy measures. As a result, companies internally use cost accounting. In this context, profit refers to the difference between revenue and costs during a given period. Revenues are represented by operating income (sales revenue and interest income) and costs are only those associated with operating expenses (e.g., wage costs, raw material costs).

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.