Return on Investment (ROI)

Would you like to invest your money? Get in touch with an expert:

Return on Investment (ROI) Definition

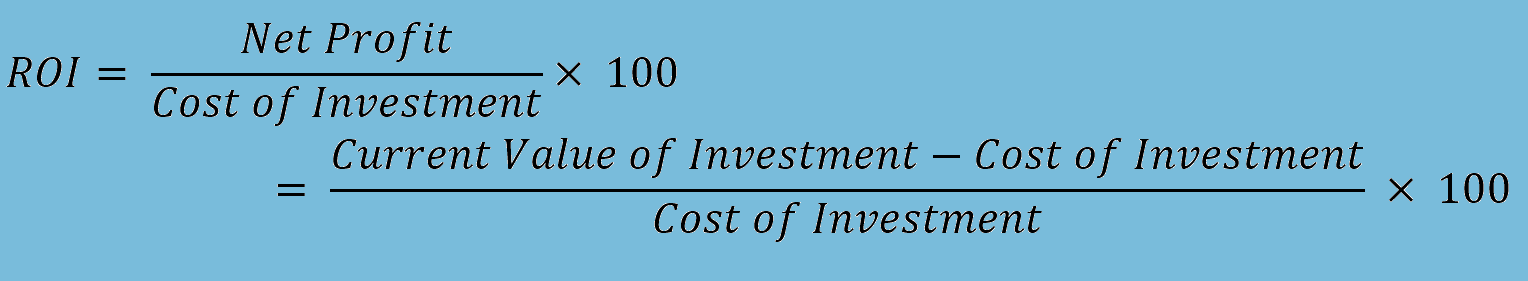

A return on investment (ROI) is a measure of the efficiency or profitability of an investment. The figure also provides a means of comparing the efficiency of different investments. To calculate ROI, we need to consider the profit of an investment in relation to the investment's costs. The ratio is therefore a measure of the profitability of a company's capital employed.

Example of ROI

An investment is considered worthwhile if the ROI calculation is positive. It is recommended, however, to invest in other investments if they have higher ROIs.

Assume that CHF 10,000 has been invested in shares of a company X. A year later, these shares could be sold for CHF 12,000. Therefore, the net profit of this investment is CHF 2000. The ROI is calculated by dividing the profit (CHF 2000) by the investment costs (CHF 10,000). This example illustrates a ROI of 20% (= (CHF 2000 / CHF 10,000) x 100). Suppose another CHF 10,000 was invested in company Y. After three years, these shares can be sold for CHF 15,000. This ROI is calculated as 50% (= (CHF 5,000 / 10,000) x 100).

In a direct comparison, it would be advantageous to invest in company Y. Nevertheless, it is important to consider the years when making a comparison. Based on the number of years, the investment in company X would be more appropriate. Furthermore, the ratio does not take into account the time value of money. In order to account for time and the time value of money, the net present value (NPV) or the internal rate of return (IRR) can be calculated alternatively.

Although the ROI cannot be compared effectively between projects with different durations, it is a valuable accounting figure. In this context, it refers to the past. This means that ROI cannot be used to evaluate future investments. Additionally, the calculation does not reflect investment risks (for example, market risks).

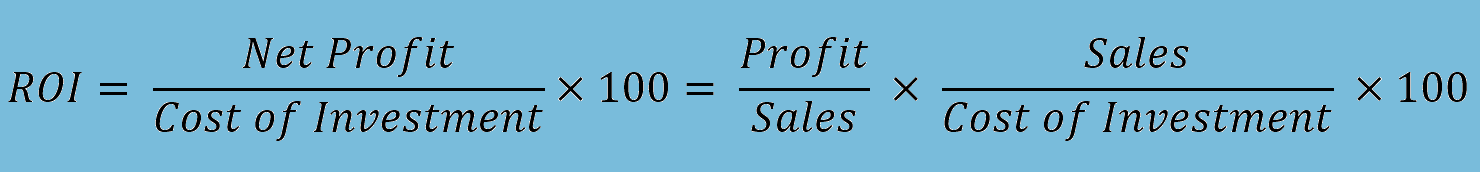

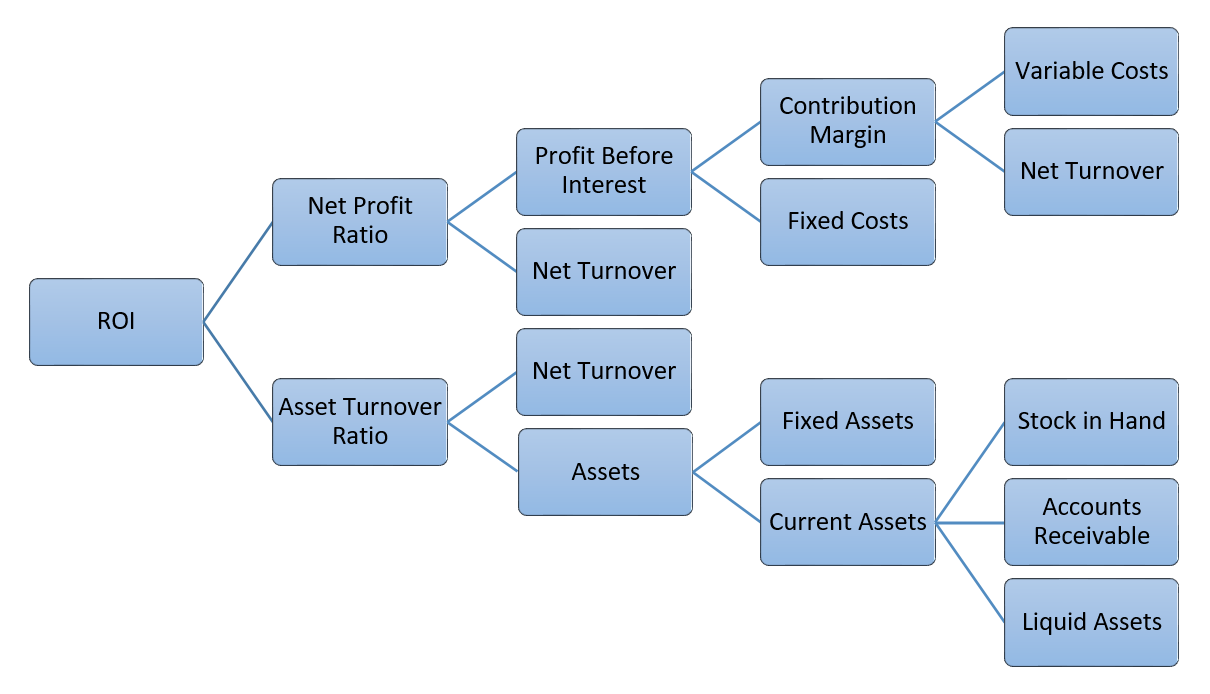

This type of calculation allows for a more precise analysis of the origin of return on investment. A high return on sales, for example, may indicate success in the sales market. There is also the possibility of breaking down the formula even further, which is known as the Du-Pont analysis. This formula enables an extended analysis of the influences of higher-level key figures.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.