Would you like to invest your money? Get in touch with an expert:

The Swiss Market Index (SMI) is a blue-chip index and serves as the primary stock index in Switzerland. It was launched on June 30, 1988, with a base value of 1500 points. Currently, the SMI stands at 11,491.80 points (as of May 25, 2022). A blue-chip index represents stocks of well-known and financially stable publicly traded companies, referred to as blue chips. These stocks offer investors consistent returns, making them desirable investments and serving as a measure of the relative strength of an industry or economy.

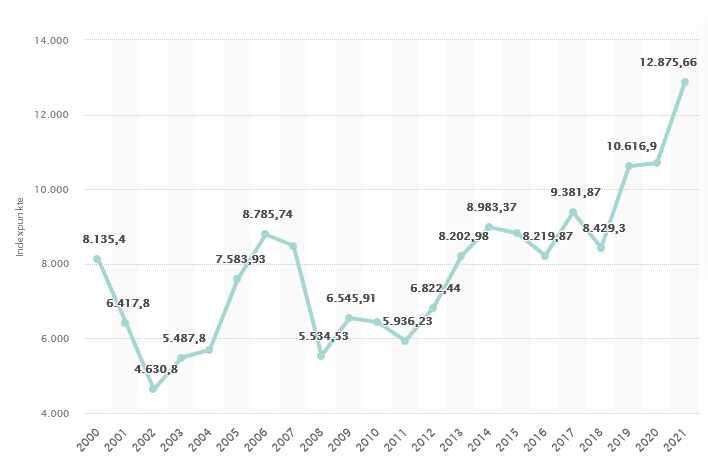

The chart illustrates the annual price data of the SMI from 2000 to 2021. During this period, the index rose from 8135.5 points to 12,875.66 points.

Annual price data of the SMI from 2000 to 2021; Source: www.statista.com

The SMI comprises the 20 largest companies within the Swiss Performance Index (SPI), accounting for approximately 80% of the total market capitalization. The SPI, known as the Swiss Performance Index, is one of the key stock indices. It encompasses nearly all Swiss-listed companies (companies domiciled in Switzerland or the Principality of Liechtenstein), thereby reflecting the Swiss stock market. Presently, the SPI stands at 14,708.47 (as of May 25, 2022) and includes 220 companies.

The SMI operates on the principle of Free Float, adjusting the total shares outstanding by the respective fixed ownership. Consequently, the index considers only the currently tradable portion. Moreover, it implements a weighting mechanism where no single company within the 20 constituents can hold a weight greater than 20% of the index. The SMI serves as the benchmark index for the Swiss stock market. The SMI is published both as a price index and a performance index, known as the SMIC. Typically, a price index does not incorporate dividend payments.

As of May 25, 2022, the following companies are part of the SMI:

A performance index combines all dividend payments, capital gains, and cash disbursements with the net stock price, determining the index return over a defined period.

Conversely, a price index (total return index) computes returns solely based on the weighted market value, disregarding cash disbursements. Certain investors argue that a performance-based calculation offers a more precise measure of performance when contrasted with the price-based approach.

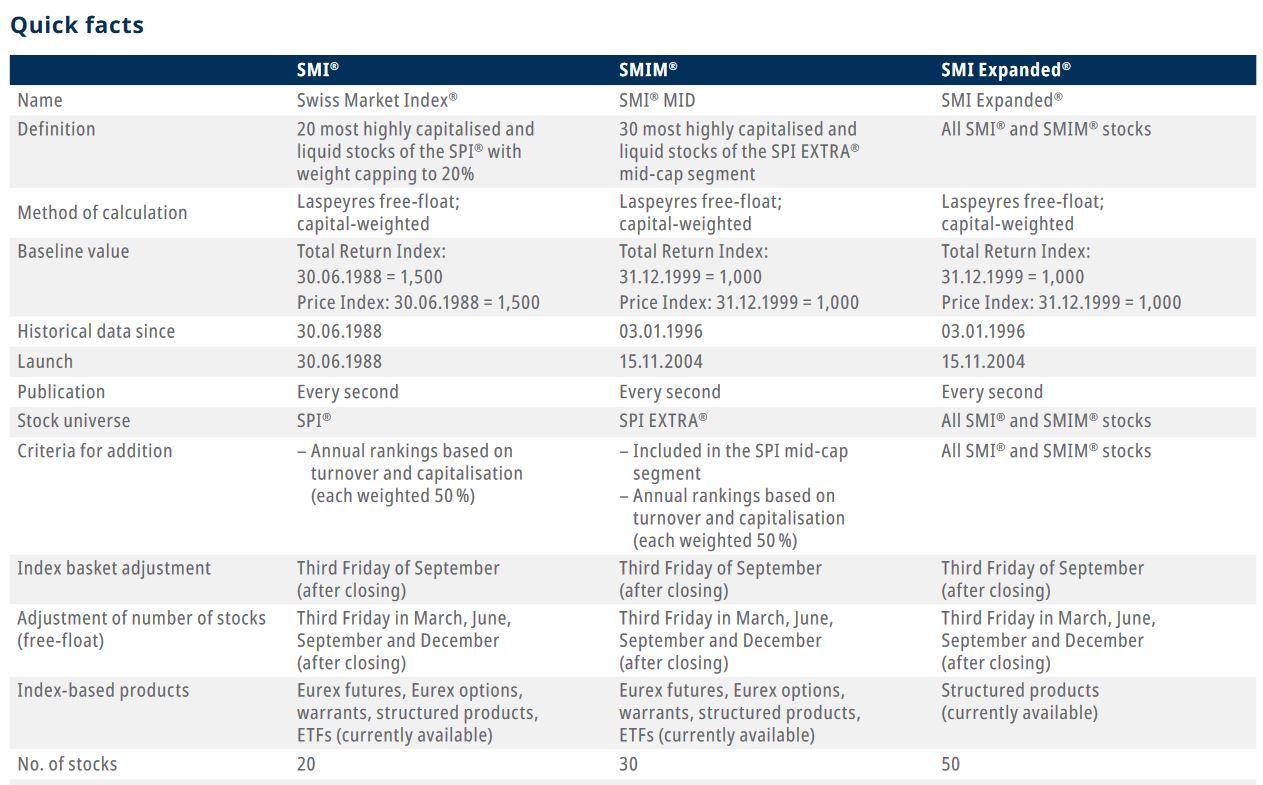

The SMI family consists of the 50 largest and most liquid stocks in the Swiss stock market. Alongside the SMI, the family includes the SMIM and SMI Expanded indices. The SMIM comprises the 30 most liquid and highly capitalized mid-cap stocks, whereas the SMI Expanded encompasses all the stocks from both the SMI and the SMIM.

The table presents the key information about these indices:

Source: www.six-group.com, Swiss Market Index -Family September 2018

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.