Real Rate of Return

Would you like to invest your money? Get in touch with an expert:

What is the Real Rate of Return?

Over time, the real rate of return determines the actual purchasing power of money. It is therefore more accurate to measure investment performance by the real rate of return rather than by the nominal rate of return. The real rate of return differs from the "normal" rate of return in that it is adjusted for inflation. In financial terms, the nominal rate of return represents the net gain or loss on an investment expressed as a percentage of the initial investment cost. Due to the fact that nominal rates of return are not adjusted for inflation, nominal rates of return are typically higher than real rates of return. However, when there is zero inflation, for example, yields are roughly equal, but when there is deflation, real yields are higher than nominal yields.

The time value of money can also be calculated by discounting. When inflation is taken into account, we call this the real rate of return (or the inflation-adjusted rate of return).

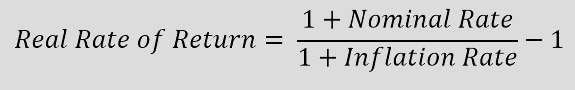

The Formula for the Real Rate of Return

In order to calculate the real rate of return, the nominal rate of return must be subtracted from the inflation rate.

Assuming a bond pays a 4% return per year and the inflation rate is 1%, the real rate of return is only 3%. Inflation has reduced the purchasing power of money over the past year.

Historically, stocks have quoted at around 8% in nominal terms. Assuming that inflation is 2%, the real rate of return on equities would be around 6% (8% - 2%).

Nominal or Real Rate of Return?

A question arises as to whether an investor should generally rely on a nominal or real rate of return. An investment's real rate of return provides a detailed historical overview of its performance. However, when it comes to investment opportunities, you will only ever find information about nominal returns. Inflation must be known in order to calculate the real rate of return. When assessing the return achieved, investors should take into account other factors such as taxes, investment fees, and transaction costs in addition to inflation adjustment. It is only then that the "actual" return can be determined. When choosing between different investment options, the "actual" return can be helpful. An independent wealth manager will be able to assist you in making this assessment.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.