Yield Curve

Would you like to invest your money? Get in touch with an expert:

What is a Yield Curve?

The word “yield” refers to the potential profit or return that can be obtained by investing in bonds. A diagram illustrating these returns is called the yield curve. The yield of the bond is plotted against the duration of the bond (maturity). The slope of the curve is therefore an indicator of interest rate changes, economic activity and growth. A very popular yield curve is the yield curve of government bonds.

Generally, there are different types of yield curves. Bonds with a longer maturity usually offer a higher yield, because risk (for example credit risk) increases with maturity. Thus the curve rises. Occasionally, yield curves can be flat or inverted. Investors may be adversely affected by interest rate movements. This is because the price of a bond falls when market interest rates rise, and vice versa. This risk is also referred to as yield curve risk.

Types of Yield Curves

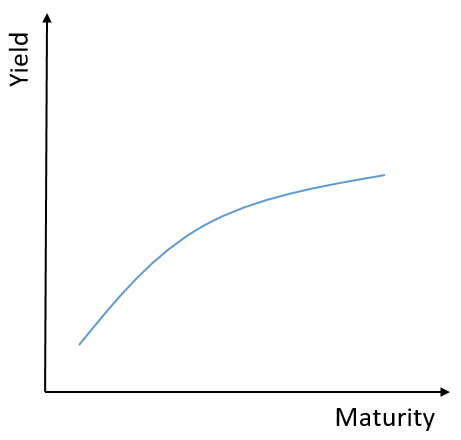

The normal yield curve

As mentioned above, the normal yield curve is upward sloping. Therefore, short-maturity bonds offer low yields and the amount of the yield rises with the term to maturity. A shorter maturity is usually less risky (default risk, inflation risk) and thus the yield of short-maturity bonds is lower. An example of a normal yield curve can be seen in the figure.

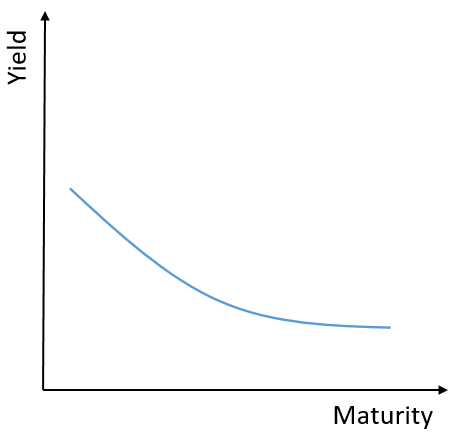

The inverted Yield Curve

Yield curves of this type are very rare in the real world. The inverted yield curve occurs when a bond with a short maturity pays a higher yield than a bond with a long maturity. Thus, the inverted yield curve is downward sloping. A downward slope of the yield curve is indicative of a recession. An inverted yield curve can also be caused by the central bank intervening in the system at times of inflation.

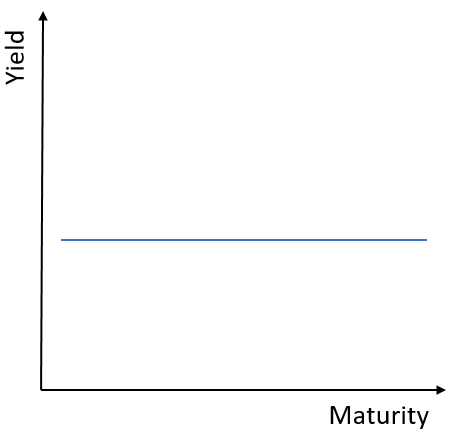

The flat Yield Curve

Just like the inverted yield curve, a flat yield curve only appears in exceptional circumstances. An economic transition may be indicated by this shape of the yield curve. A normal yield curve may become an inverted yield curve, or vice versa. Accordingly, a flat yield curve indicates an uncertain economic situation. Investors expect a similar yield due to this uncertainty, regardless of the maturity of the bond. Sometimes, this shape is observed at the end of a period of rapid economic growth. The yield curve can also flatten if the central bank is expected to raise interest rates.

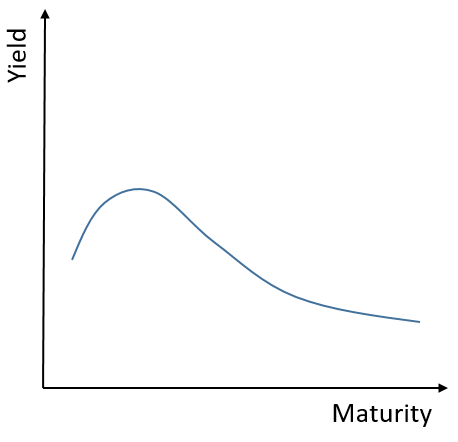

Die humped Yield Curve

A humped yield curve initially rises with maturity. The yields on bonds with a long-term maturity, however, continue to fall. This shape often reflects investor uncertainty.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.