Keynesianism

Would you like to invest your money? Get in touch with an expert:

What is Keynesianism?

Keynesianism, established by John Maynard Keynes in the 1930s, is an economic policy theory within the field of economics. This approach involves government intervention in the market economy. Essentially, its aim is to influence supply and demand, and thus market equilibrium, in order to stabilize the economy. In other words, Keynesianism revolves around steering production, employment, and inflation through the total expenditures of the government.

Every product or service is demanded by households and businesses. For instance, every household requires a certain amount of groceries. Depending on the demand, suppliers adjust their product or service offerings. If a company's product or service is in high demand in the market, the company will increase its production and consequently require more employees. Employees receive wages and can afford products and services, thereby generating further demand. Thus, high demand positively impacts a company's production. Ideally, companies can utilize their full production capacity, which in turn promotes full employment. Low demand, on the other hand, leads to reduced production capacity for suppliers. Prolonged decreases in demand can result in layoffs. These layoffs reduce the population's purchasing power, subsequently dampening the demand for products and services.

In Keynesianism, the government influences this mechanism.

When the economy falters and demand diminishes (recession), the government increases spending to stimulate demand. The government is advised to

save during periods of robust economic performance, such as by raising taxes. Essentially, the government's approach should be counter-cyclical.

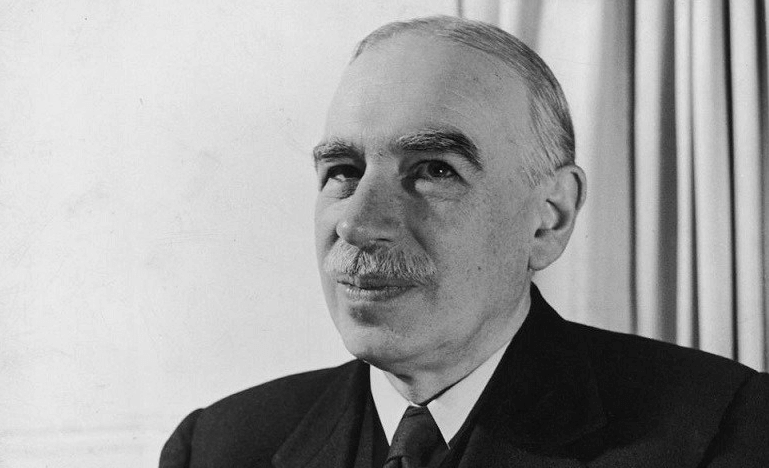

John Maynard Keynes, Source: www.history-biography.com

Opponent of Keynesianism - Monetarism

The counterproposal to Keynesianism is Monetarism. Monetarism asserts that interventions in the economy can have negative consequences (inflation). The core of Monetarism is the control of the money supply. Proponents of Monetarism believe that the market is capable of restoring a new equilibrium without any intervention. Companies and investors, pursuing their self-interest and benefiting from lower input prices, would, following a widespread economic downturn, realign production and prices to equilibrium, unless hindered otherwise.

Keynes held the view that the Great Depression seemed to refute this theory. Production was low, and unemployment remained high during that time. Keynes declined the notion that the economy would naturally return to a state of equilibrium. Instead, he advocated the idea that during recessions, business pessimism and certain aspects of the market economy would exacerbate economic weakness, leading to further collapse in overall demand. For this reason, state intervention is deemed necessary.

Pros and Cons of Keynesianism

One advantage of Keynesianism is its emphasis on full employment. Historically, the application of Keynesianism has had a stabilizing effect on the economy during periods of severe recession.

The drawback of Keynesianism is the potential for state indebtedness. With substantial government debt, it might become necessary for the government to resort to printing money to settle its debts. This can lead to inflation. After the government has spent money, it must then save, which often results in tax increases once the economy recovers. The government is advised to act counter-cyclically. However, accurately determining the economic cycle becomes essential, and this is not always feasible.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.