Annual Growth Rate (CAGR)

Would you like to invest your money? Get in touch with an expert:

What is the Compound Annual Growth Rate (CAGR)?

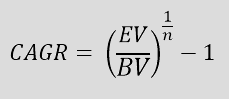

Generally speaking, the compound annual growth rate (CAGR) refers to the relative increase of a quantity over a given period of time. As such, it may also be referred to as the rate of return required for an investment to grow from its initial value to its final value. Profits are assumed to be reinvested at the end of each period during the investment period. In this sense, the annual growth rate is not an accurate measure of the rate of return on investment. Instead, it is a number that describes the rate of growth. The annual growth rate is used to measure a variety of economic factors.

Example

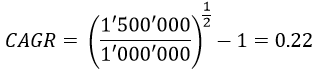

It was estimated that the company X had a value of CHF 1,000,000 at the beginning of the year. Its value increased to CHF 1,400,000 after one year. The company has been valued at CHF 1,500,000 after two years of operation. The initial value (BV) is therefore CHF 1,000,000. CHF 1,500,000 represents the ending value (EV). Consequently, the first year's return was 40% and the second year's return was 7%. Therefore, the growth rates were quite different. This may be due to the volatility of the stock market. In this regard, the annual growth rate smooths out the effect. This two-year period (n) has experienced an average annual growth rate of 22%. As a result, the annual growth rate is also useful for comparing different investment types and maturities.

Advantages and Disadvantages of the Annual Growth Rate

The annual growth rate has the advantage of being quick and easy to calculate. Risk, however, is not taken into account when calculating the annual growth rate. Assume that an investor compares a savings account with a safe return with a stock portfolio with an uncertain return. The annual growth rate of the savings account is 1%, while the annual growth rate of the stock portfolio is 5%. The stock portfolio appears to be the better investment option. There is, however, a possibility that the stock portfolio will perform worse in future periods as a result of market volatility.

Furthermore, any additions or withdrawals made by an investor during the period are not taken into account. Inflows of funds could cause the annual growth rate to be distorted upward at the end of the period. Furthermore, downward trends (or growth) are not taken into consideration. Suppose the stock portfolio generated an above-average return in the first four years of a 10-year period. However, the return decreased continuously over the following years. In the annual growth rate, this downward movement is not directly visible. IRR (Internal Rate of Return) is the most appropriate measure of the performance of more complicated investments and projects or those involving a variety of cash inflows and outflows. When evaluating investment opportunities, an experienced asset manager will provide assistance and consider all relevant factors.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.