Deflation

Would you like to invest your money? Get in touch with an expert:

What is Deflation?

The term "deflation" refers to the general decline in prices. Both goods and services are affected by this decline. Therefore, during deflation, a currency's purchasing power increases. There is often a connection between deflation and a decline in the supply of money and credit in the economy. However, it is also possible for prices to decline as a result of increased productivity and technological innovation. The effects of deflation are not always felt by all industries. A partial deflation may also be possible.

A deflationary period is characterized by a decrease in the nominal cost of capital, goods, services, and labor, while the relative price remains the same. Deflation benefits consumers because they are able to purchase more for the same nominal income in the short term. The fall in prices, however, has a negative impact on many other sectors and areas. Disadvantages are particularly prevalent in the financial sector. Suppose, for example, that borrowers were required to repay their loans with money, which purchasing power is currently higher than when they borrowed the money at the beginning. As a result, the interest rate on loans increases indirectly. Since deflation increases the real debt burden, the state also suffers from deflation.

Basically, there is price deflation and money supply deflation. The more dangerous type of deflation is money supply deflation. In the economy, there is a lack of money circulating. The lower the amount of money in circulation, the less will be invested and consumed in the long run. In turn, this will have a detrimental effect on production, i.e., fewer products will be produced. Typically, if a company produces less, it will lay off employees and decrease wages. Therefore, the government receives lower tax revenue, and in addition, these individuals will consume fewer goods and may not be able to repay their loans. Therefore, a deflationary spiral may develop.

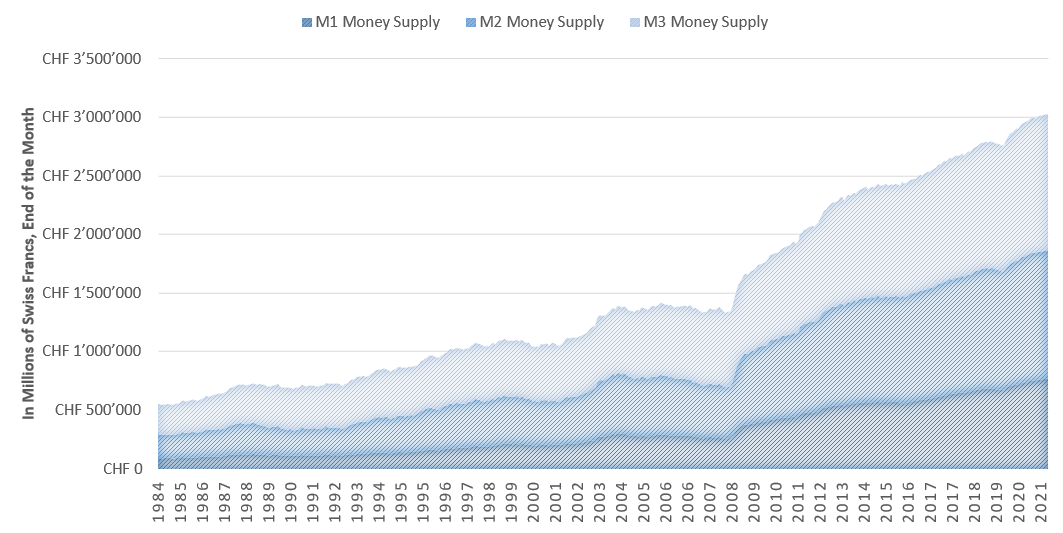

According to the following chart, the Swiss money supply continues to grow. Money supply M1 consists of currency in circulation, demand deposits, and deposits in transaction accounts. The M2 money stock additionally includes savings deposits, while the M3 money stock also includes time deposits.

The term price deflation refers to the decline in consumer prices. There is a common argument among economists that when prices fall, consumers decrease their consumption since goods become more affordable over time. However, this effect is not always observed and depends on a variety of factors. In general, when deflation is the result of innovation with full employment, it is a positive sign for an economy. This type of deflation, however, occurs very rarely and, most importantly, does not affect all sectors equally.

The Cause of Deflation

Deflation generally occurs in the following circumstances:

Deflation risk =

declining economic growth

+ declining inflation rate

+ declining long-term interest rate

Monetary deflation is generally caused by a reduction in the supply of money or liquid financial instruments redeemable in money. Central banks have the power to influence the supply of money. If the supply of money and credit decreases while economic output remains unchanged, the price of all goods will decrease. Inflation is often caused by the artificial expansion of the money supply, for example. In the 1930s, the United States experienced a very large deflation. Money supply fell sharply as a result of bank collapses.

There are, however, other causes of falling prices, such as a decline in aggregate demand. The aggregate demand may shift due to reduced government spending, a stock market collapse, consumer saving, and tighter monetary policy (e.g., higher interest rates). In the same manner, an increase in productivity can result in a decrease in prices if economic output exceeds the supply of circulating money and credit. Industry sectors that benefit from new technologies usually experience this phenomenon because they are able to operate more efficiently using new technologies. This will allow for a reduction in production costs as well as other costs, resulting in a lower price for the product. Due to the fact that not all prices are affected by the decline, this process differs from general price deflation.

Deflation and Changing Views on its Impact

The Great Depression in the United States caused most economists to view deflation as a negative phenomenon. In response, most central banks adjusted their monetary policies to increase the money supply steadily, even though this resulted in chronic price inflation and excessive borrowing among debtors.

According to British economist John Maynard Keynes, deflation contributes to a downward cycle of economic pessimism during recessions when owners of assets see their prices fall and subsequently limit their investment intentions. An entire theory of economic depression has been developed by economist Irving Fisher based on the concept of debt deflation. It was Fisher's belief that debt repayment following a negative economic shock could result in a reduction in credit availability in the economy. It is possible that this may lead to deflation, which further puts pressure on debtors, resulting in more redemptions and a downward spiral into economic depression.

After the 2004 study by Andrew Atkeson and Patrick Kehoe, economists have increasingly questioned the old interpretations of deflation. Over a 180-year period, Atkeson and Kehoe found that 65 of 73 deflation episodes were not followed by an economic downturn, while 21 of 29 depressions were not followed by deflation. While deflation and price deflation are subject to a variety of opinions, there is a consensus that deflation may be beneficial.

Monetary Policy and the SNB: An Excursus

It has already been mentioned that central banks are able to influence the money supply. In this way, the central bank can strive to achieve a deflation rate. This may be desirable, for example, if inflation is to be controlled. In order to accomplish this goal, the central bank employs monetary policy instruments. It is the responsibility of the Swiss National Bank (SNB) to maintain the liquidity of the Swiss money market. Art. 9 of the NBG specifies the permitted tools in this context. Open market operations and standing facilities are generally the instruments of monetary policy.

Open Market Operations

In the context of auctions, the SNB may conduct repo transactions. To accomplish this, the SNB uses quantity or interest rate tenders. The SNB can provide liquidity to counterparties (e.g. banks) through a quantity tender. The SNB establishes a price for liquidity (repo rate). As part of an interest rate tender, counterparties request liquidity at a specific price (interest rate) they are willing to pay. These repo transactions may mature overnight (i.e., from one day to the next) or over a period of several months. Repo transactions can also be conducted electronically. An offer may be published by the SNB at any time.

Standing Facilities

The intraday facility provides liquidity to counterparties through repo transactions at no interest during the day. Repayment must be made within the same banking day.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.