What is the profit yield?

The earnings yield is the reciprocal of the price/earnings ratio (P/E ratio) and is an indicator of the value of a share. The earnings yield refers to the profit of the last 12-month period divided by the current market price per share. The earnings yield thus shows the percentage of a company’s earnings per share. Investors can use the earnings yield to determine whether certain stocks are overvalued or undervalued. Asset managers use the earnings yield to determine the optimal asset allocation. A high earnings yield may indicate an undervalued stock, while a low earnings yield may mean the stock is overvalued. Growth prospects must be taken into account, as stocks with high growth potential are often valued higher and may therefore have a low earnings yield even though the share price continues to rise. The earnings yield is also referred to as the earnings yield. Earnings Yield (EY) is an important key figure of Magic Formula Investing, which goes back to the value investor Joel Grennblatt.

The calculation of the profit yield

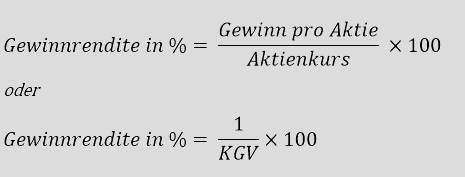

The earnings yield can help investors to assess whether a share should be bought or sold. The following formula is used to calculate the earnings yield:

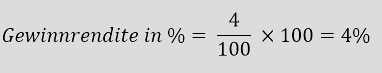

Let’s assume that a share currently has a price of CHF 100. In the past financial year, the share generated a profit of CHF 4 per share (EPS). The earnings yield is therefore calculated as follows:

Excursus: The P/E ratio of the share is 25 (= CHF 100 / CHF 4). This means that the share is valued at twenty-five times the annual profit.

The earnings yield compared to the price/earnings ratio

The advantage of the earnings yield compared to the price/earnings ratio is in the eye of the beholder. The earnings yield is popular when it comes to long-term investments. The P/E ratio tends to reflect the potential for short-term price appreciation. However, both say practically the same thing. Ultimately, both ratios are influenced by the share price and earnings per share and it is simply a question of which of the two factors is in the numerator and which is in the denominator of the calculation.

For investors who want toachieve stable dividend income, the earnings yield can be the appropriate measure for assessing the return, as it shows at a glance what return a share could generate. The higher the share price rises, the lower the earnings yield (if earnings remain unchanged).

The more valuable/expensive an investment is, the lower the profit yield appears to be, and vice versa. However, this is a misleading conclusion, as value and price are not the same. The only conclusion that can be drawn from both the earnings yield and the P/E ratio is the current price (share price) in relation to the current earnings. The two key figures only allow limited conclusions to be drawn about the value of an investment. It should be noted that investments with high valuations or high price/earnings ratios could generate higher earnings over time, which can lower the P/E ratio and thus increase the earnings yield. This is exactly what growth-oriented investors are hoping for. A good example of this is Amazon, which initially had low profits and therefore a high P/E ratio, as almost all of its earnings were reinvested in company growth.

On the other hand, investments with weak valuations and low P/E ratios can generate lower earnings over time, e.g. due to fundamental problems, which in turn results in a higher P/E ratio and ultimately a lower return on earnings. One example of this is Nokia, which was unable to assert itself against the competition from Apple & Co. in the smartphone trend.

However, a high return on earnings and a low P/E ratio can also indicate an undervaluation of the company and a low return on earnings or a high P/E ratio can indicate an overvaluation. It is therefore important that the return on earnings and the P/E ratio are not viewed in isolation when making investment decisions. It therefore makes sense to consult an expert to carry out a comprehensive analysis before investing in a company.

Disadvantages of the profit yield

Earnings yields, like the P/E ratio, vary greatly depending on the sector, country and year. When comparing earnings yields of different companies, only companies in the same sector should be selected. Another disadvantage of the earnings yield is that it is calculated retrospectively. However, past profits do not necessarily say anything about future profits. In addition, share pricesalso fluctuate strongly in some cases. This means that the earnings yield changes with the selected daily price. To avoid this, the mean value of the share price can be used in the calculation. The net profit can also be distorted (e.g. by one-off effects). A good asset manager is aware of the difficulties involved in calculating the earnings yield and the P/E ratio and can therefore provide the best possible assistance in calculating and selecting investments.