Would you like to invest your money? Get in touch with an expert:

Recent years have seen an increased interest among investors in exchange traded funds (ETFs). A ETF is a portfolio of securities that functions much like a mutual fund. In most cases, ETFs represent a specific index. However, ETFs can also track a specific sector, commodity, or other asset class. Due to supply and demand for the assets within an ETF, the price of its shares fluctuates during a trading day. ETFs are therefore securities that can be traded on exchanges. In other words, its share price allows it to be bought and sold on the exchange during the day, as well as being shorted. This is a major difference between mutual funds and stocks, which trade at their net asset value (NAV) only once a day after the close of the stock market.

ETFs can be structured in a variety of ways. ETFs may be used to track the price of specific commodities, for example. However, it is more common to monitor entire indices containing a large number of securities. It is also possible for ETFs to represent specific investment strategies, such as Arc's Innovation ETFs.

Among the first exchange-traded funds was SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index and is still actively traded today. ETFs have the advantage of low expense ratios and fewer brokerage commissions as compared to buying stocks individually.

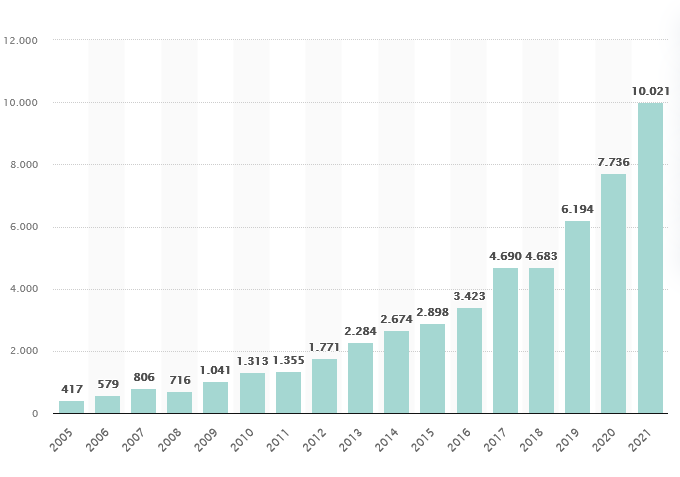

According to the chart below, ETFs are also becoming increasingly popular around the world. Global assets under management in ETFs have increased from $417 billion in 2005 to $10,021 billion in 2021.

Development of global assets under management in ETFs from 2005-2021, assets in billions of us dollars, source: www.statista.com

ETFs hold multiple underlying assets, making them popular products when it comes to risk diversification (spreading risks). Additionally, ETFs may hold a variety of investments. In addition to focusing on a particular sector, ETFs can also be spread across a variety of sectors. It is the same for a global focus or one that is directed towards a particular country. Similarly, the number of investments in an ETF can vary greatly.

In addition to generating income, exchange-traded funds (ETFs) can also be used to hedge or, in some cases, offset risk in an investor's portfolio.

Generally, ETFs fall into two categories: passively managed ETFs and actively managed ETFs. The objective of passive ETFs is to track the performance of a broader index.

Portfolio managers determine which securities to include in an actively managed ETF. However, these funds are typically more expensive than passive ETFs, although they may offer some advantages over passive ETFs. This section discusses the characteristics of actively managed ETFs.

Stock ETF / Shares - ETFs

Stock exchange-traded funds are investments that represent a single industry or sector through a combination of stocks. The goal of the fund is to create a diversified ETF that includes both high-performing companies as well as new companies that have the potential for growth. In contrast to traditional stock funds, ETFs offer lower fees and do not involve the ownership of any securities.

Bond ETF / Bond ETFs

Investing in bond ETFs provides regular income. The income distribution of these funds is determined by the performance of the underlying bonds. The types of bonds that can be invested in include bonds issued by governments, corporations, and municipalities. There is no maturity date associated with bond ETFs, in contrast to their underlying assets. Most often, they are traded at a premium or discount to the actual bond price.

Industry/Sector ETFs

ETFs focused on specific sectors or industries are known as industry or sector ETFs. A Consumer Staples ETF, for example, consists of companies operating in the consumer staples sector. By tracking the economic success of companies in an industry, sector ETFs aim to participate in the positive developments of that industry.

Currency ETFs

A currency ETF can include domestic and foreign currencies. Their purpose is to speculate on the price of currencies. Additionally, they serve as a means of diversifying a portfolio. Furthermore, they allow importers and exporters to hedge against price fluctuations in foreign exchange markets. Meanwhile, there is even an ETF solution for bitcoins.

Commodity ETFs

Commodity ETFs invest in commodities (such as oil or gold). A commodity exchange-traded fund diversifies a portfolio and serves as a hedge against downturns. ETFs that track commodities provide some hedging against stock market downturns if they are uncorrelated with stock markets, but this is not always the case. Shares of a commodity exchange-traded fund are generally cheaper than owning physical commodities because certain economies of scale are at play: Insurance and storage costs, for instance, are shared by all ETF investors.

Leveraged ETFs

In the case of leveraged exchange-traded funds, the goal is to achieve a specified multiple of the return on the underlying investment. If the index rises by 5%, a 2× leveraged Index ETF will yield a 10% return. In order to leverage their returns, these products are based on derivative instruments such as options and futures contracts. In addition, there are leveraged inverse ETFs that strive to achieve an inverse multiplied return. Financial products of this nature are considered to be highly speculative and should only be used with great caution. It is worth consulting a specialist such as an independent wealth manager.

Inverse ETFs

The objective of an inverse ETF is to profit from a decline in stock prices by selling stocks. An individual who engages in short selling sells a stock in anticipation of a decline in value in order to repurchase it at a lower price in the future. An inverse ETF uses derivatives to sell a stock. As a result, they are essentially bets against the market, for example, an inverse ETF increases when the market declines.

It is possible to trade ETFs through online brokers, for instance, as well as through traditional broker-dealers. In a similar manner to stocks, shares of ETFs can be traded through a normal custody account at the house bank. Investors who prefer a more passive approach may choose a robo-advisor. ETFs are frequently included in the portfolios of robo-advisors.

ETF screening tools are one of the best tools for narrowing down ETF options. Many brokers offer these tools to assist in sorting through the thousands of available ETFs. In general, you can filter ETFs according to their volume, performance, holdings, and also costs, such as the total expense ratio (TER), for example. The justETF platform provides a useful tool for screening.

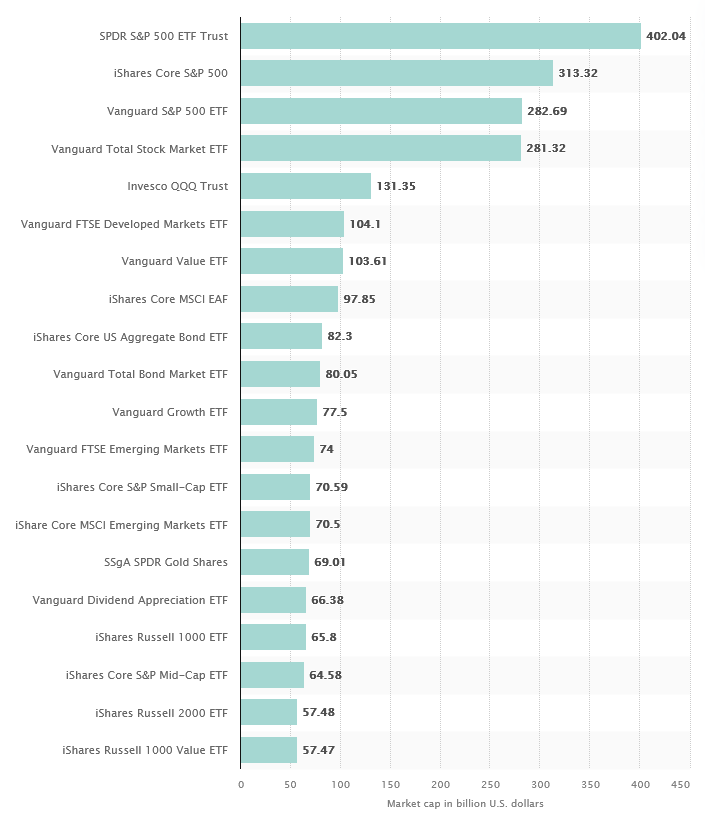

The following figure illustrates the most popular ETFs on the market. The SPDR S&P 500 ranks first:

Market Capitalisation of the Largest Exchange-traded Funds (ETFs) Worldwide, as of 22 April 2022

Source: www.statista.com

- Costs: As far as costs are concerned, ETFs typically offer low expense ratios and hardly any brokerage commissions. The costs of purchasing every stock included in an ETF portfolio individually would be expensive for investors. Because investors only need to make one purchase and one sale, the transaction costs are reduced. It is even possible to trade certain low-cost ETFs commission-free, thereby further reducing investor costs.

- Access to many stocks from different sectors.

- Mapping of specific industries and themes: There are ETFs that focus on specific industries or themes, such as sustainability.

- Risk management through diversification: ETFs based on an entire stock index offer investors diversification. Furthermore, ETFs offer relatively small holdings, since no minimum deposit is required.

- Since most purchases and sales of ETFs take place via exchanges, and the ETF sponsor is not required to redeem shares each time an investor wishes to dispose of them, or issue new shares each time it wishes to acquire them, an ETF is more tax efficient than a mutual fund. Redemption of shares in a fund can trigger a tax liability, so listing the shares on an exchange can reduce tax costs.

An survey conducted by JP Morgan Chase asked 320 respondents what they considered to be the most important features of ETFs. 60% of people perceive the low cost as the main benefit. However, caution is also needed here: Not all ETFs are low-cost. It is worth consulting a specialist here to work out an optimal investment strategy.

- The fees associated with actively managed ETFs are higher. With actively managed ETFs, portfolio managers are more involved in buying and selling company shares and changing holdings within the fund. The managers of these funds seek compensation (similar to traditional actively managed funds).

- The composition of an ETF that focuses on only one industry may not provide true diversification of risk.

- Lack of liquidity can hinder transactions.

- ETFs have raised concerns about their impact on the market. There is a concern that the high demand for these funds will inflate stock values and contribute to the creation of vulnerable bubbles. Some exchange-traded funds rely on portfolio models that are untested under various market conditions and can lead to extreme inflows and outflows from the funds. This can have a negative impact on market stability. Since the financial crisis, ETFs have played an important role in market meltdowns and instability. In May 2010, August 2015, and February 2018, ETF problems contributed to flash crashes and market declines.

- One criticism of ETFs is market concentration. This is the case since with ETFs, investors no longer own the stocks, and so they no longer own the companies - but the fund companies do. In some cases, certain ETF fund companies own a significant stake in a large number of companies around the world, depending upon their size. As a result, they have considerable influence over the management of these companies.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.