Limit Order

Would you like to invest your money? Get in touch with an expert:

A limit order is an order that specifies the price at which a security may be sold or bought. When an investor sells securities with a limit order, he or she sets a price that cannot be undercut. When an investor buys securities, he or she sets a price that cannot be exceeded. Hence, the limit represents the maximum amount he or she is willing to pay. Limit sell orders are executed only at the limit price, or at a higher price. Limit buy orders are executed only at the limit price, or at a lower price. The specification provides investors with enhanced control over their trading prices.

It is also possible to execute a partial order, when the seller is willing to sell at the offered price but does not wish to sell the same number of shares as the investor wanted to buy per limit order. The buyer may also not wish to buy as many shares as the seller offered at the limit order price.

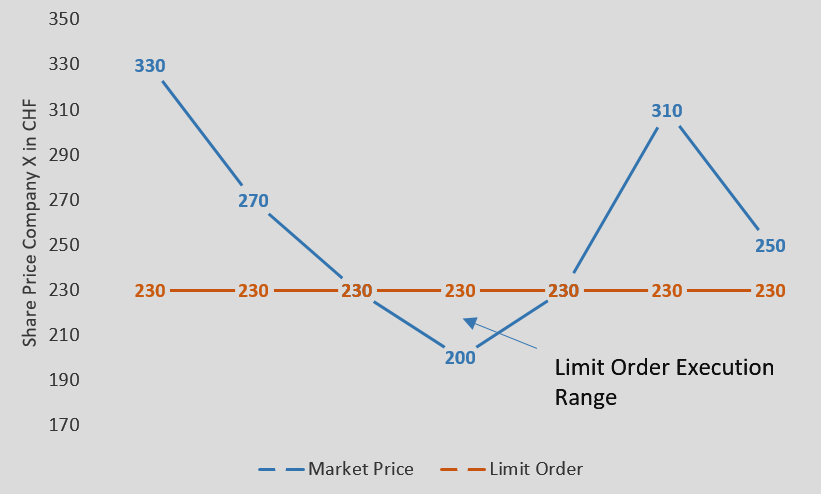

Example of a Limit Buy Order

Consider the case of an investor, who wishes to buy shares of company X. The investor is willing to pay a maximum price of CHF 230 per share. Currently, the share price is CHF 330. As soon as the price of the share reaches CHF 230 or below, the investor instructs the trader (for example through his bank) to buy a certain amount of shares. In addition, the order may also be valid for a specified period of time (days, weeks, months, or even a year). As a result, limit orders can also be specified with an expiration date. In response to the investor's request, the trader places an order to buy the shares with a limit of CHF 230. The limit order is only executed if the price is below CHF 230. Thus, there is the possibility that the order will not be executed if the price never falls below CHF 230.

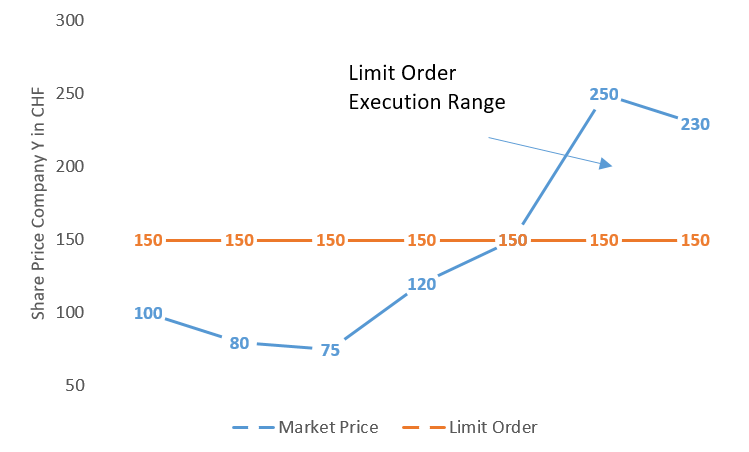

Example of a Limit Sell Order

If an investor places a limit sell order, he or she intends to sell share Y for a fixed price. In any case, the investor is only willing to sell the share if he is offered or paid a certain price in accordance with his expectations. Therefore, the investor instructs his trader to sell a certain amount of company Y's shares. As a condition, the offer or payment per share must be at least CHF 150. A trader then places a sell order with a limit of CHF 150. When another investor is willing to buy the offered quantity of shares Y for CHF 150, the order is executed. The limit sell order will expire if no buyer is found during the period when the order is valid.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.