Money-Weighted Rate of Return (MWR)

Would you like to invest your money? Get in touch with an expert:

What is the Money-Weighted Rate of Return (MWR)?

An investment's money-weighted rate of return (MWR) is a

measure of its performance. In order to calculate the MWR,

the present value of all cash flows is equated with the original investment's value. Consequently, the MWR is equivalent to the Internal Rate of Return (IRR).

MWR includes the amount and timing of the inflow and outflow of funds.

The Calculation of the Money-Weighted Rate of Return

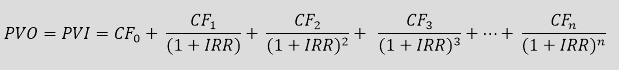

In order to calculate the MWR, the following formula is used. Calculating the MWR (or IRR) requires the use of trial and error.

By taking into account the level and timing of cash flows, this method of measuring the return on assets provides a good indicator of portfolio performance. Accordingly, the MWR (or IRR) is the discount rate at which the net present value (NPV) is zero. It is therefore worthwhile to invest if the return on investment exceeds zero. This means that the present value of inflows equals the present value of outflows.

where:

PVO = Present Value Outflows

PVI = Present Value Inflows

CF0 = Initial Cash Investment (Cash Flow Period 0)

CFn = Cash Flow Period n

IRR = Initial Rate of Return

Example of the Calculation of the Money-Weighted Rate of Return

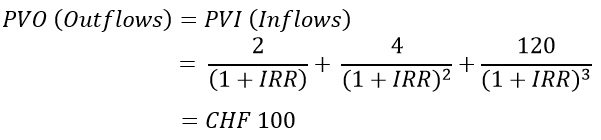

A discount rate (r) must be applied to each inflow or outflow so that PV (inflow) equals PV (outflow).

Consider the case of an investor who buys a stock for CHF 100. The investor receives a dividend of CHF 2 in the first year and a dividend of CHF 4 in the second year. Afterward, the investor sells the stock for CHF 120. Generally speaking, the MWR is defined as the rate that meets the following equation. By using a financial calculator, we can solve the equation for r and determine that the MWR is 8.2%.

Disadvantages of the Money-weighted Rate of Return

By using MWR, it is not possible to compare the performance of fund managers or wealth managers when they do not influence cash flows. During times of high portfolio performance, MWR gives greater weight to the performance of the portfolio. This is the reason for the term "money weighted".

Cash flows are generally beyond the control of wealth managers. Investors add or subtract money from the portfolio. If a large sum of money is added immediately before a positive performance, this will have a positive impact on the MWR. If, however, the portfolio suffers a loss after the addition of money, then the addition of money was deemed a negative action. For the purpose of comparing returns independent of time, the time-weighted rate of return is suitable. Unlike the MWR, time-weighted returns are not affected by transactions. A MWR is calculated by taking into account money in- and outflows. This complicates the comparison of investment returns.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.