Net Asset Value (NAV)

Would you like to invest your money? Get in touch with an expert:

What is Net Asset Value (NAV)?

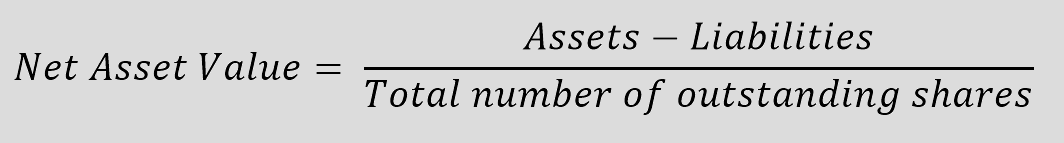

Net asset value (NAV) represents the total value of assets. An investment fund's NAV is calculated by adding up all its assets and then subtracting all its liabilities. The result is then divided by the number of outstanding units/shares. The outcome is the net asset value per unit. NAV is most commonly used in the context of mutual funds or exchange-traded funds (ETFs). Future prospects are not included in NAV.

A company's NAV is typically similar to its book value. Companies with high growth potential are valued higher than their NAV. A comparison can be made between the NAV and the market capitalization of a company.

A mutual fund is a financial instrument that takes money from a large number of investors. The money is then invested in securities such as stocks, bonds, and money market instruments. The investors receive shares in proportion to their investment. NAV determines the price of each share.

The

price changes of stocks are announced during the day. Mutual funds, however, are priced

according to the end-of-day method, which is based on the activities of the securities in the fund.

An Example of How NAV is Calculated

Consider an investment fund that consists of a variety of securities. These securities are valued at CHF 200 million in total. The total value is calculated by adding the closing prices of each asset on a daily basis. Furthermore, the investment fund has cash in the amount of CHF 10 million and receivables in the amount of CHF 12 million. Moreover, there are CHF 20 million of current liabilities and CHF 5 million of non-current liabilities accrued. As of the end of the day, CHF 100,000 has been accrued as income, and CHF 20,000 has been accrued as expenses. The shares of the fund amount to 10 million.

The NAV is therefore calculated as follows:

NAV = (CHF 200 million + CHF 10 million + CHF 12 million + CHF 100’000 – CHF 20 million – CHF 5 million – CHF 20’000) / 10 million

NAV = CHF 19.7

As of this date, the investment fund's units are trading at CHF 19.7 per unit.

The Net Asset Value of Closed-End Funds and Open-End Funds

Open-end funds may issue an unlimited number of shares, are not traded on exchanges, and are valued at their daily NAV at the close of trading.

Closed-end funds are listed on an exchange, are traded similarly to securities, and may trade at a price that differs from their NAV. Funds that are traded on exchanges, such as Exchange Traded Funds (ETFs), are closed-end funds. In the same way as stocks, ETFs trade on the stock market. Therefore, their market value may be different from their actual NAV. By identifying timely trading opportunities, active ETF traders can generate profitable trading profits. ETFs calculate their NAV daily at market close for the purpose of reporting. Additionally, the "indicative" net asset value (iNAV) is calculated several times a minute in real-time.

The Difference of the Net Asset Value to the Redemption- and Issue Price of a Funds

The redemption price of an investment fund unit is usually the net asset value per unit. It is possible, however, that the redemption price may differ due to a redemption fee charged by the fund company. This may result in a lower redemption price. It is generally necessary to pay the front-end load when purchasing units in an investment fund. Therefore, the issue price may be slightly higher than the NAV.

NAV and Fund Performance

Calculating the difference between two points in time is one way to evaluate the performance of a mutual fund. The NAV at the beginning of the year can be compared with the NAV at the end of the year, for instance. While the change in value may be considered a measure of the fund's performance, it is not the best indicator of a mutual fund's performance. This is due to the fact that mutual funds pay dividends and interest to their shareholders. A distribution must also be made to shareholders with respect to accumulated realized capital gains. These distributions cause the NAV to decrease. Therefore, these returns are not reflected in the absolute values of the NAV when comparing two points in time.

Thus, the annual total return, or the actual return on an investment over a given period, is a better indicator of the performance of a mutual fund. A further measure is the compound annual growth rate (CAGR), which is the average annual growth rate over a specified period of time.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.