Price-to-Sales Ratio (P/S)

Would you like to invest your money? Get in touch with an expert:

What is the Price-to-Sales Ratio?

Price-to-sales ratios (P/S ratios) are calculated as a comparison between the share price of a company and its revenue/sales. Hence, the P/S ratio serves as another financial ratio (see also the price-to-earnings ratio) that indicates how the financial markets value each monetary unit of sales generated by an organization. To put it another way, the P/S ratio measures how much an investor is willing to pay for one franc of sales per share.

Shares with a low ratio may be undervalued, while shares with an

above-average ratio may be overvalued. An effective method for determining price-to-sales ratios would be to compare them with those in the same industry. Generally, shares are cheap if the P/S ratio is low compared to that of comparable competitors.

The Calculation of the P/S Ratio

A company's P/S ratio is determined by dividing its market capitalization by its total sales over a set period of time (usually 12 months). A second method would be to divide the share price of a company by its sales per share. Sales per share can be calculated by dividing a company's sales by the number of shares issued.

The typical twelve-month period used for the P/S ratio is usually the last 12 months (4 quarters, also referred to as "trailing 12 months" or TTM). The last or current financial year may also be used. P/S ratios based on forecast sales for the current year are known as forward P/S ratio.

Example: Calculating the Price-to-Sales Ratio

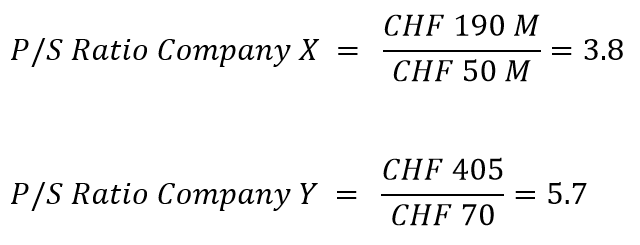

In 2020, a company X generated sales of CHF 50 million. The company has a market capitalization of CHF 190 million. The share price of company Y is CHF 405 and the sales per share is CHF 70.

Company X has a P/S ratio of 3.8 and company Y has a P/S ratio of 5.7. If the two companies operate in the same industry, their price-to-sales ratios can be compared. According to the P/S ratios, company X shares are more favorable than company Y shares. As a general rule, shares with a P/E ratio below one are considered very favorable. In spite of this, the comparison should always be made at the industry level, as different industries may have different price-to-sales ratios.

Advantages and Disadvantages of the Price-to-Sales Ratio

The price-to-sales ratio (P/S) can have advantages over the price-to-earnings ratio (P/E). It is rare for very young companies, for example, to generate profits. In this context, the P/S ratio is an alternative to the P/E ratio. P/S ratios allow companies to be valued independently of their profits. In addition, the P/S ratio is very useful when a company experiences a loss. Investing in a company that is currently making losses may be worthwhile if it is a growth company that is making large investments aimed at increasing its growth in the future. For example, Amazon generated no significant profits for a long period of time since it invested all its earnings in the development of the company. Even so, it would have been worthwhile to make an investment. Sales are also less easily influenced than profits, which is another advantage.

Among the disadvantages of the P/S ratio is the fact that it only considers sales and does not take profit into account. It may also be possible to influence sales, for example by increasing sales through high discounts. However, this may result in a reduction in profit margins, resulting in a reduction in profit per unit. It is not appropriate to compare the profitability of different industries since not all industries will be able to convert sales to profits in the same way. Furthermore, the ratio does not take into account corporate debt. For instance, the enterprise value-to-sales ratio considers the debt of a company. Therefore, an investor should evaluate a company in terms of both quantitative and qualitative factors, rather than just looking at one ratio. Consequently, it is wise to seek the assistance of an expert, such as an independent wealth manager.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.