Return on Equity (ROE)

Would you like to invest your money? Get in touch with an expert:

What is Return on Equity?

The return on equity (ROE) measures the profitability of an organization. This measure is used to evaluate the efficiency with which a company is able to generate profits. In order to calculate ROE, net income is divided by shareholders' equity. An acceptable return on equity depends in part on the industry in which a company operates.

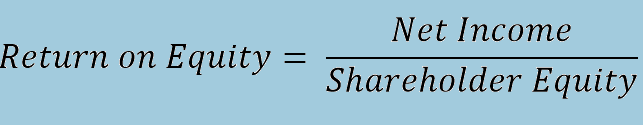

The Formula for Calculating the Return on Equity (ROE)

The ROE is calculated as follows. Generally, a company's net profit can be derived from its profit and loss statement and its equity can be derived from its balance sheet:

where,

net income: prior dividend payment to common shareholder + after dividend payment to preferred shareholder + after payment of interest to lenders.

If the return on equity is lower than the interest rate on the capital market, it would be more lucrative to invest the money on the capital market. Within the same industry, ROEs of companies are comparable. A good company should have a return on equity that is at least equal to or greater than the average for its industry. In cases where a company's ROE is extremely high compared to its industry, it is important to assess whether it is a result of a low equity ratio. In order to maintain a low equity ratio, the company can pay high dividends or buy back shares.

Examples for the Calculation of the Return on Equity

Example 1

An investor would like to compare the return on equity of two companies. In 2021, Company A had a net income of CHF 10 million. Assuming that the average shareholder equity amount is 150 million Swiss francs, the return on equity is 6.67%.

In 2021, Company B produces a net income of CHF 5 million with shareholder equity of CHF 100 million. This results in an ROE of 5%. The two companies can be compared if they belong to the same industry. Company A has managed its equity capital more efficiently in 2021 than company B.

Example 2

An analysis of two companies with the same return on equity may benefit from including growth factors:

Consider the analysis of two companies. The return on equity of Company X is 10% and 20% of its net income is distributed as dividends. As a result, company X retains 80% of the net profit.

The return on equity of Company Y is also 10%, although it distributes only 5% of its net income to its shareholders. Thus, 95% of the net income remains in the company (also called the retention rate).

The sustainable growth rate of a company can be calculated by multiplying the ROE by the retention rate. This would translate into 8% for Company X (= 10% x 80%). The sustainable growth rate of Company Y is 9.5% (= 10% x 95%). As a result, company Y appears to be more attractive since it has a higher sustainable growth rate. The dividend paid by company X, however, is higher.

The payout ratio can also be multiplied by the ROE to calculate the so-called sustainable dividend growth rate. This is 2% (= 20% x 10%) for company X and 0.5% (= 5% x 10%) for company Y. If a company pays a much higher or lower dividend than the sustainable dividend growth rate, the company must also be examined more closely.

In general: A share price that is growing slower than the sustainable growth rate might be considered undervalued or risky. There is a need to examine the company more closely if the share price growth is significantly above or below the sustainable growth rate of the company. Additionally, caution is advised if the dividend growth rate is far from the sustainable rate.

Causes of a Very High Return on Equity (ROE)

A company's ROE that is very high in comparison to its peers within the same industry should be viewed with caution. ROEs that are very high may be attributed to the following factors:

- Consider the case of a company that has been unprofitable for several years. There is a reduction in equity due to the losses. Since the average equity of the company is very low, the company will have a high ROE once it becomes profitable.

- Over-indebtedness may also result in a very high return on equity. In order to calculate ROE, debt is subtracted from assets for equity. Therefore, with the deduction of more debts, the denominator becomes smaller. Debt is frequently taken on by companies in order to buy back their own shares, as this has a positive effect on their earnings per share (EPS). However, this does not have any impact on the actual growth rate. In the event of a net loss or negative equity, ROE should not be calculated. Negative equity is often caused by excessive debt or uneven profitability.

Any return on equity that is negative or extremely high should be examined in further detail. A negative return on equity may be caused by an excellent management team and a cash flow-based share buyback program. This is, however, a very rare occurrence. An ROE that is negative cannot be compared to an ROE that is positive and is therefore difficult to evaluate or compare.

The Difference between ROE and ROI

Return on investment (ROI) can also be used to evaluate the efficacy or profitability of an investment. The return on equity (ROE) indicates how well equity capital is being used by a business, while the return on investment (ROI) indicates how well capital is being used to earn money (investment). As a result, both ratios are intended to provide an explanation of and assessment of earnings. ROE is calculated by comparing net income to shareholders' equity, while ROI only considers invested capital.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.