Total Expense Ratio (TER)

Would you like to invest your money? Get in touch with an expert:

What is the Total Expense Ratio (TER)?

The Total Expense Ratio (TER) denotes the expenses linked to the operation and management of a collective investment vehicle, like a fund. Its components can widely vary across countries. In Switzerland, the Swiss Fund Association (SFA) has implemented the EU Commission's recommendation via a directive outlining all relevant costs. Consequently, the TER encompasses all charges and fees during the fund's operational phase, covering management and custodian fees, along with various expenses like auditing, legal counsel, and publications, as detailed in the income statement. Operating expenses do not include incidental costs arising from the purchase and sale of investments. These costs are part of the production costs of the investments and are therefore part of the capital gains/losses on sale.

The TER assesses the operating expenses relative to the assets managed by the investment vehicle, serving as an indicator of its operational efficiency. These costs vary across funds, with the largest portion typically comprising fees paid to the investment manager or advisor.

For investors, understanding the TER is crucial as it directly reduces returns from the investment vehicle. Typically expressed as a percentage of the assets managed, its actual impact depends on the performance of the investment vehicle. These expenses cover the operational costs associated with the investment vehicle. The more actively managed a fund, the higher its TER due to increased costs like personnel expenses. Conversely, passively managed index funds usually incur lower costs, replicating an index through automated processes. In contrast, actively managed funds employ research analysts to assess potential investments.

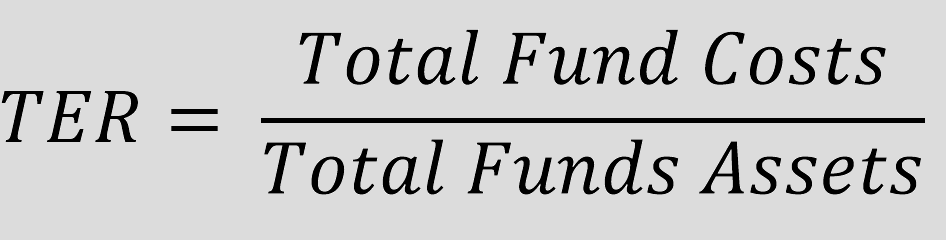

The Formula for the Total Expense Ratio (TER)

- Total Fund Costs represent all costs associated with managing and operating the fund during a specific period.

- Total Funds Assets denotes the average value of the fund's total assets under management during the same period.

The resulting TER is expressed as a percentage and signifies the proportion of the fund's average assets that are allocated toward operating expenses.

Disadvantages of the Total Expense Ratio (TER)

There's often a mistaken assumption that the Total Expense Ratio (TER) encompasses all costs linked to a collective investment vehicle. Regrettably, this isn't the case. Certain costs are overlooked, such as one-time charges and additional expenses like transaction fees resulting from asset transactions. Moreover, the components included in the TER can significantly differ from country to country.

Due to these limitations, the TER isn't entirely suitable for effectively comparing various collective investment vehicles. Investors need to consider costs beyond those covered by the TER. These unaccounted expenses can constitute a substantial part of the overall costs. The Real Total Expense Ratio (RTER or realTER) is a variation of the TER that includes all fund-level costs. However, this metric is rarely disclosed in fund prospectuses or other informational documents. A competent wealth manager possesses extensive knowledge of potential costs and can offer optimal guidance in this domain.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.