Would you like to invest your money? Get in touch with an expert:

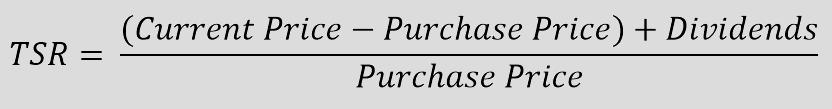

Total Shareholder Return (TSR) represents the overall gains from an investment and is expressed as a percentage of the invested capital. To calculate TSR, it considers both capital gains and dividends from a stock. It could also encompass special dividends, stock splits, and warrants. In essence, the stock return formula consolidates all profits to offer a comprehensive perspective of the investment.

Stocks typically offer two sources of income: capital gains, denoting an increase in stock price, and ongoing returns like dividends. When computing TSR, an investor factors in only the dividends they actually received or were entitled to. Crucial in this calculation is the ex-dividend date. Usually, the ex-dividend date for a stock is a day before the record date, meaning an investor who buys the stock on or after the ex-dividend date won't receive the announced dividend. Instead, the dividend goes to the person who owned the stock the day before the ex-dividend date. Thus, when computing TSR, an investor needs to consider the ex-dividend date, not the dividend payment date.

TSR is particularly valuable when assessed over a prolonged duration, providing an understanding of the investment's enduring value – a highly precise measure for the success of most individual investors. It serves exceptionally well in scrutinizing venture capital and private equity investments, typically entailing numerous cash injections over a company's lifecycle, culminating in a singular cash outflow during an IPO or sale.

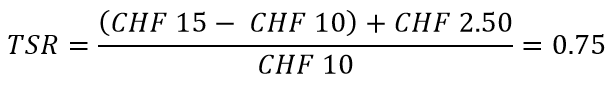

Assuming an investor purchases 200 shares of a company. Each share costs CHF 10. After three years, the stock is trading at CHF 15 per share, indicating a rise in the share price. Additionally, CHF 2.50 per share has been distributed to the investors. The TSR is calculated as follows:

The investor gained CHF 7.50 per share, considering the share price increased by CHF 5 per share, coupled with a dividend payout of CHF 2.50 per share. This is also referred to as the cash value of the stock return. CHF 7.50 represents 75% of the investor's initial investment.

Advantages

- Ease of Comprehension: The metric is straightforward and simple to compute, providing a clear overview of the overall financial benefit an investor could have gained during a specific period.

- Percentage Representation: Expressed as a percentage, it facilitates easy comparison with industry benchmarks or the TSR of other companies within the same sector, enhancing comparative analysis.

- Long-Term Performance Indicator: TSR serves as a reliable measure for long-term performance assessment.

Disadvantages

- Historical Focus: Similar to many metrics, TSR is retrospective, offering no projection into the future and reflecting past performance.

- Company-Wide Assessment: TSR is presented solely for the entire company and doesn’t delineate specific divisions within the organization.

- Market Perception Influence: Being externally focused, TSR mirrors the market's perception of performance, making it susceptible to fluctuations when stock prices vary short-term.

- Limited Evaluation Scope: It doesn’t measure the absolute size of an investment or its return, potentially favoring investments with high percentages, even if the absolute return value is low.

- Inapplicability for Intermediate Cash Flows: TSR can't be applied when investments generate intermediate cash flows.

- Exclusion of Capital Costs: Additionally, it doesn't account for capital costs and cannot be used to compare investments across different time frames.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.