Unlevered Beta

Would you like to invest your money? Get in touch with an expert:

What is the Unlevered Beta?

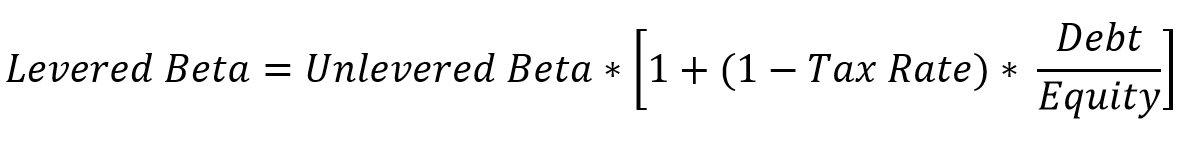

In general, beta measures market risk, which refers to the potential for changes in market prices. Beta takes into account both equity and debt risks and is also referred to as Levered Beta or Equity Beta. The formula for Levered Beta is as follows:

Statistically speaking, beta represents the slope coefficient when regressing a stock against the benchmark market index. Beta is also a crucial component of the Capital Asset Pricing Model (CAPM). In essence, beta indicates how much a stock fluctuates in comparison to the market.

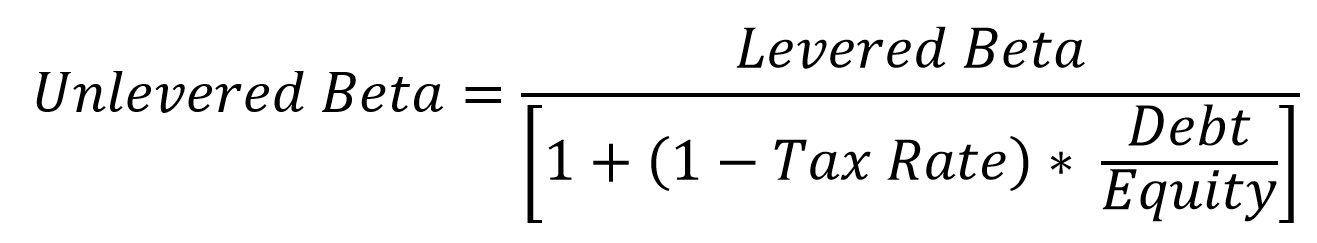

A portion of beta is attributed to the degree of leverage. This reflects the ratio between a company's debt and equity. Unlevered Beta adjusts beta for all favorable and unfavorable effects arising from the use of debt capital. Put differently, Unlevered Beta portrays the risk solely attributable to the company's assets. When an investor intends to purchase stocks of a company, Unlevered Beta serves as a better measure to gain clarity about the composition of risk. Unlevered Beta is also known as Asset Beta. The formula for Unlevered Beta is as follows:

Example of Calculating Unlevered Beta

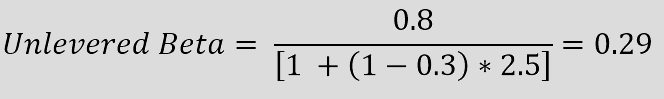

To adjust the Levered Beta for debt, both the degree of leverage and the corporate tax rate are required.

Let's assume a company has a Levered Beta of 0.8, the leverage ratio is 2.5, and the corporate tax rate is 30%. The calculation for Unlevered Beta is as follows:

If the Unlevered Beta is positive, investors will tend to invest in the company's stocks when rising prices are anticipated. On the other hand, a negative Unlevered Beta encourages investors to consider investing in the stock when falling prices are expected.

Systematic Risk and Beta

Systematic risk is the type of risk that, unlike unsystematic risk,

cannot be eliminated through diversification (the distribution of assets across various investment opportunities). Companies have no control over systematic risk. Examples of systematic risk include natural disasters, wars, and inflation.

Beta is intended to measure this risk. It compares the risk of, for instance, a stock to the risk of the broader market. A stock is considered risky if its risk is higher than the market's risk. If the Beta is 1, the stock carries the same level of risk as the market. If the Beta is less than 1, the stock bears less risk than the market, while a stock with a Beta greater than 1 is riskier than the market. For example, Nestlé's Beta (1 year) is 0.88. The value is less than 1, indicating that the company is currently less risky than the overall market.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.