Weighted Average Cost of Capital (WACC)

Would you like to invest your money? Get in touch with an expert:

What is Weighted Average Costs of Capital (WACC)?

The Weighted Average Cost of Capital (WACC) encapsulates a company's average after-tax cost of capital from various funding sources, like stock and debt. It mirrors the expected return both bondholders and shareholders seek to invest in the company. Shareholders anticipate specific returns, making this expected return a cost for the company. Falling short might prompt share sell-offs, affecting share prices and overall company value.

Higher WACC often connects to stock volatility and risky debt, as investors seek greater returns to counter perceived risks. While WACC is widely used to appraise projects and acquisitions, its complexity lies in elements like fluctuating equity costs. Determining the cost of equity (Re) involves estimating shareholder expected returns, considering stock's uncertain value. This estimation, using models like CAPM, doesn't assure precise future forecasts due to reliance on historical data.

Understanding WACC helps assess a company's potential profitability. Lower WACC signals a healthy business attracting investor funds at a reduced cost, while higher WACC relates to riskier businesses demanding higher returns.

The calculation of WACC reflects a company's attractiveness for investments and the returns it assures, aiding in evaluating investment options based on financial strength and risk. This metric influences crucial financial decisions by determining if a project's return exceeds the capital's cost. Moreover, WACC often acts as the benchmark rate for accepting an investment project, commonly comparing a new project's Internal Rate of Return (IRR) against it.

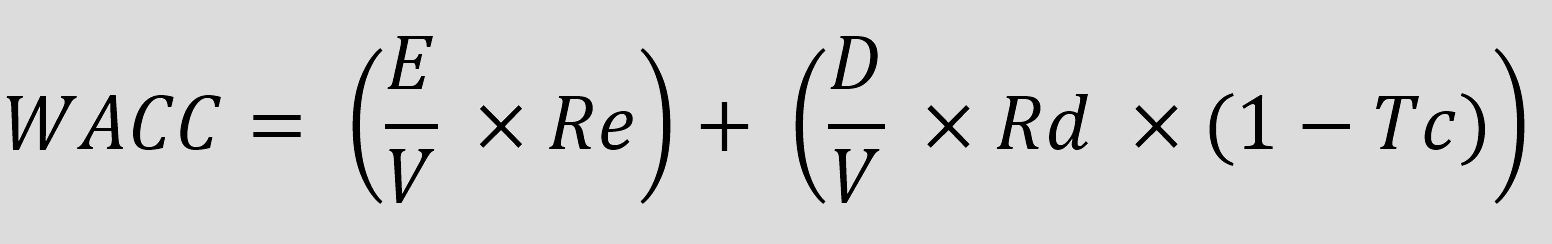

The Formula to Calculate WACC

The WACC is calculated by taking the proportionate weights of a company's equity and debt and multiplying these weights by their respective costs. The cost of equity, representing shareholders' expected return, is multiplied by the equity proportion in the company's total capital structure. Simultaneously, the after-tax cost of debt, adjusted for tax benefits, is multiplied by the debt proportion in the capital structure. These weighted costs of equity and debt are then summed to derive the WACC.

where:

E=Market value of the firm’s equity

D=Market value of the firm’s debt

V=E+D

Re=Cost of equity

Rd=Cost of debt

Tc=Corporate tax rate

Example: How to Calculate WACC

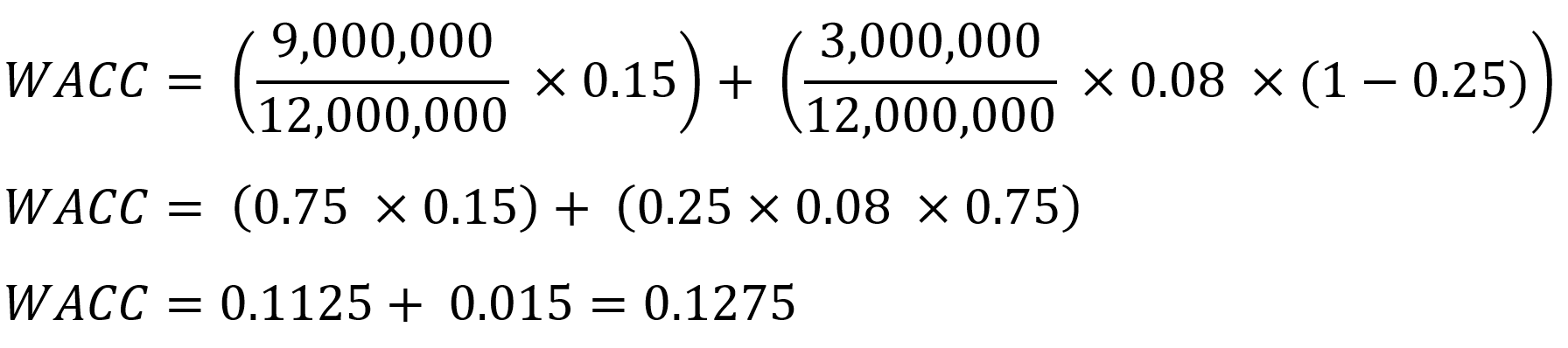

TechABCCo Inc., a innovative technology enterprise, holds a CHF 3 million market value of debt alongside a CHF 9 million market capitalization (equity value).

Suppose the cost of equity for TechABCCo Inc., indicative of shareholders' expected minimum return, is 15%. Computing E/V yields 0.75 (CHF 9,000,000 of equity value divided by CHF 12,000,000 of total financing), resulting in a weighted cost of equity of 0.1125 (0.75 × 0.15).

To determine TechABCCo's weighted cost of debt, the calculation of D/V amounts to 0.25 (CHF 3,000,000 in debt divided by CHF 12,000,000 in total capital). Assuming a cost of debt at 8% and considering a tax rate of 0.25, or 25%, the weighted cost of debt computes to 0.015 (0.25 × 0.08 × 0.75).

Adding the weighted cost of debt (0.015) to the weighted cost of equity (0.1125) culminates in a WACC of 0.1275, equivalent to 12.75%.

This derived value signifies TechABCCo Inc.'s Weighted Average Cost of Capital, indicating how much the company needs to spend on average to attract investors and achieve the expected return. These relate to the company's financial position and risk profile compared to other investment options.

Limitations of WACC

Determining the cost of equity and debt is crucial in computing WACC, yet it poses challenges for private firms lacking publicly accessible data. Public companies have diverse methods for this, but there's no universal formula, making equity cost estimation complex within WACC calculations.

WACC assumes a constant debt-to-equity ratio, influencing a company's forecasted value. However, this assumption conflicts with reality, as these ratios tend to fluctuate, impacting WACC predictions.

In conclusion, while the Weighted Average Cost of Capital (WACC) offers a comprehensive approach to assess a firm's cost of capital and project feasibility, its calculation complexity as well as its assumptions necessitate caution and supplementation with other metrics for robust investment decisions.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.