Xetra

Would you like to invest your money? Get in touch with an expert:

What is Xetra?

Xetra is an

electronic trading platform operated by the Frankfurt Stock Exchange. Xetra was introduced in 1997 and

enables the trading of shares, bonds, funds, warrants, and commodity contracts. Xetra was one of the first global electronic trading systems and still lists the DAX 30 index. The DAX 30 is the benchmark index for the German stock market. On all German stock exchanges, Xetra is

used to conduct more than 90% of all equity trading. Thus,

Xetra is the largest of seven German stock exchanges. Xetra also settles around 30% of all trades in exchange-traded index funds (ETFs) in continental Europe. Xetra's market share in DAX stocks is greater than 60% in Europe.

The Xetra Trading Model

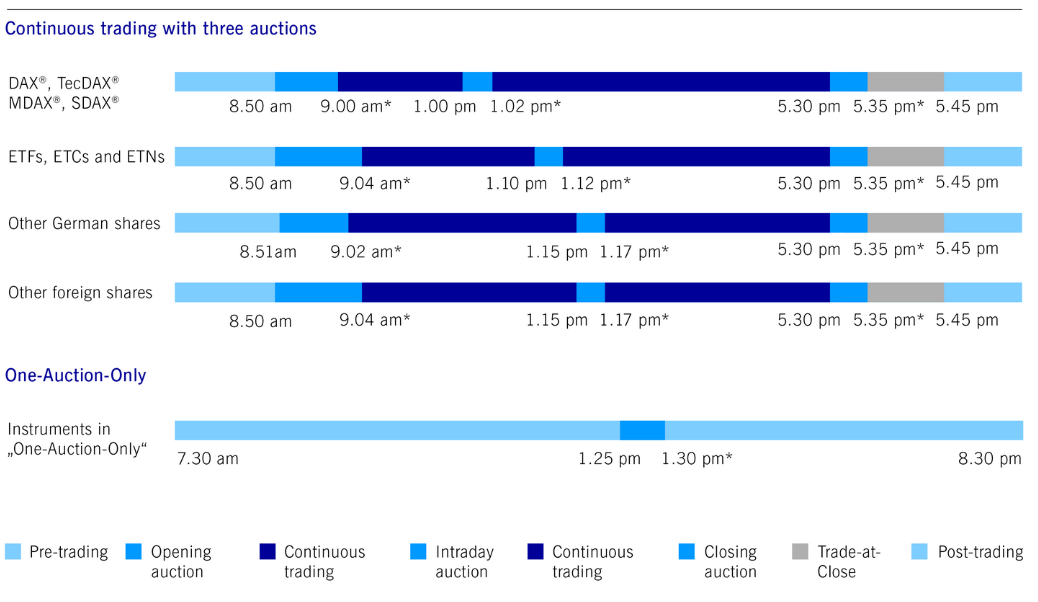

Prices are determined on Xetra according to clearly defined rules. Prices are set using market orders and limit orders. It is possible, however, to specify additional order types. Furthermore, the Xetra trading platform employs a continuous trading model with auctions. Essentially, this is a combination of the trading models "Auction", "Continuous Trading", and "Trade-at-Close". Continuous trading is the process of executing orders immediately at the current market price. The trading venue pools liquidity by offering three additional auctions each day. Moreover, trade-at-close allows market participants to continue trading after the auction has closed at the official closing price for a limited period of time (maximum 10 minutes).

The following graphic shows the Xetra auction schedule.

Source: https://www.xetra.com/

*Auctions have a random end. Times stated are the earliest times of the end of an auction.

Other Electronic Trading Systems

In 1969, Instinet (originally Institutional Networks) was established as the first automated system for direct trading between U.S. financial institutions. In 1971, Nasdaq became the second automated system. The New York Stock Exchange (NYSE) launched its DOT (Designated Order Turnaround) system shortly thereafter. The SuperDOT system, introduced in 1984, increased the number of shares traded on the floor to nearly 100,000 (simultaneously). To compete with the NYSE, Nasdaq soon introduced the Small Order Execution System (SOES).

Deutsche Terminbörse (DTB), which was launched in 1990, was the first fully electronic exchange in Germany. In addition to Xetra, Xontro and Tradegate operate on the cash market, while Eurex operates on the derivatives market. Trayport is an online platform for energy and commodity trading in Europe. Trading platforms are not only operated by stock exchanges, but also by large financial brokerage firms.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.