Yield to Maturity (YTM)

Would you like to invest your money? Get in touch with an expert:

What is Yield to Maturity (YTM)?

Yield to Maturity (YTM) denotes the average annualized return on a bond if held until maturity, encompassing reinvestment of all intermittent coupon payments at a consistent interest rate. Expressed annually, YTM is also referred to as "Yield to Book" or "Yield to Redemption". Essentially, YTM signifies the internal rate of return (IRR) if the bond is retained until maturity.

Calculation of the Yield of Maturity

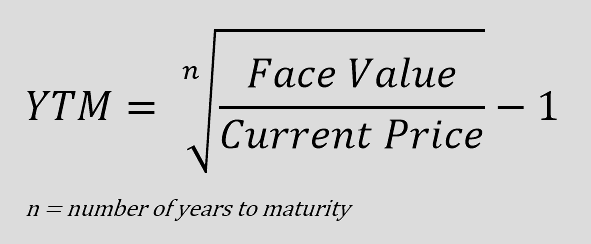

The calculation of Yield to Maturity (YTM) is intricate. Initially, the formula pertains to a discount bond, which lacks a coupon but is sold at a discount. The investor pays less for the purchase of the discount bond than the amount received at maturity, with the discrepancy indicating the yield. In this scenario, the YTM can be computed using the following formula:

The calculation becomes

more complex when coupons need to be included. If a coupon is paid every period, reinvested at a constant interest rate until the maturity date, the market price of the bond is the present value of all future cash flows. Unfortunately, the discount rate cannot be directly calculated. Nevertheless, the Yield to Maturity (YTM) can be computed using the trial-and-error method. The following formula applies:

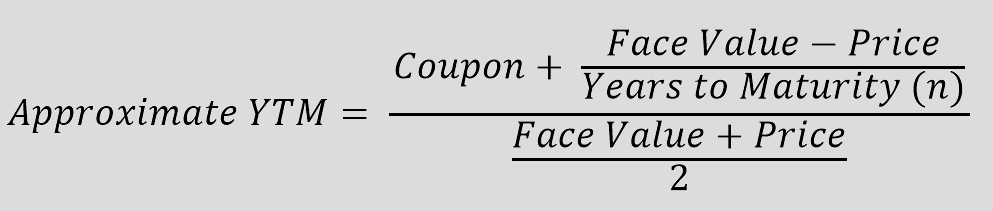

The YTM is a momentary representation of a bond's yield since the reinvestment of coupon payments at a consistent interest rate isn't always feasible. If interest rates increase, the YTM also increases, and when interest rates decline, the YTM decreases. Due to the complexity in its calculation, the YTM value can be approximated using a bond yield table, financial calculators, or online YTM calculators.

As an estimate, the YTM can be computed using the following formula:

The YTM serves as a benchmark for comparing against the desired return, enabling an investor to evaluate its investment potential. Expressed as an annual rate, it allows for comparison among bonds with varying maturities. When the YTM surpasses the coupon, the bond is trading at a discount; however, if the YTM falls below the coupon rate, the bond is trading at a premium.

Variations on Yield to Maturity

There are several common variations of YTM that consider options and are described below:

- Yield to Call (YTC): This variation assumes the bond will be redeemed before its full term.

- Yield to Put (YTP): Similar to YTC, this assumes the bond won't be held until its term's end. The holder of the put bond has the option to sell it back to the issuer early at a predetermined price.

- Yield to Worst (YTW): When a bond has multiple options (callable, puttable, exchangeable, etc.), YTW is calculated, providing the lowest potential rate of return.

Disadvantages of Yield to Maturity

YTM doesn't factor in tax payments or additional buying/selling expenses. Assumptions are also made, such as reinvesting all coupon payments at a uniform interest rate, which might not always be practical. Moreover, not all bonds reach their full term.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.