Zero-Coupon Bond

Would you like to invest your money? Get in touch with an expert:

What is a Zero-coupon Bond?

Bonds are typically issued by entities like companies or governmental institutions to raise capital. An investor buying a bond can be viewed as a creditor providing funds. Bonds usually offer periodic returns known as coupons, often paid semi-annually or annually. A zero-coupon bond is a specialized bond that doesn't provide any coupons or interest payments during its lifetime. Since zero-coupon bonds don't offer any coupon payments, investors don't earn interest.

A zero-coupon bond is traded at a discount. With a regular bond, the creditor receives the initial investment (the face value amount) at the end of the term (maturity). For instance, if a bond has a face value of CHF 1000, an investor would invest CHF 1000 at the beginning, earn interest during the term through coupons, and receive CHF 1000 at maturity. However, a bond sold at a discount allows the investor to acquire it at a lower value, for example, CHF 900. At maturity, when the bond is repaid at its full face value (without the discount), the difference constitutes the investor's gain (in this instance, CHF 100). While some bonds are traded with a discount and coupons, zero-coupon bonds are only traded at a discount, typically at a higher rate.

The investor gains an amount equal to the initial investment combined with interest that compounds periodically (usually semi-annually at a fixed rate). However, zero-coupon bonds differ in that they involve what's termed as imputed or implicit interest. This imputed interest rate serves as an estimation of the bond's interest but lacks a fixed rate. For instance, consider a bond with a CHF 10,000 face value, maturing in 10 years, offering a 5% yield, which might be purchased for CHF 5000. At the end of the 10-year period, the investor receives the face value (CHF 10,000) and the discount, which stands for the difference between CHF 10,000 and CHF 5000 (CHF 5000). This CHF 5000 represents the accumulated interest until the bond reaches maturity.

The Valuation of Zero-coupon Bonds

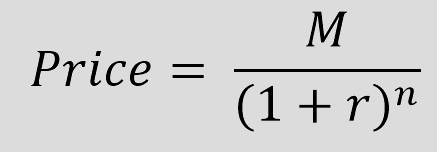

The price of a zero-coupon bond can be calculated using the following formula:

where,

M = Face value or maturity value of the zero-coupon bond

r = Desired/required interest rate

n = Number of years until maturity

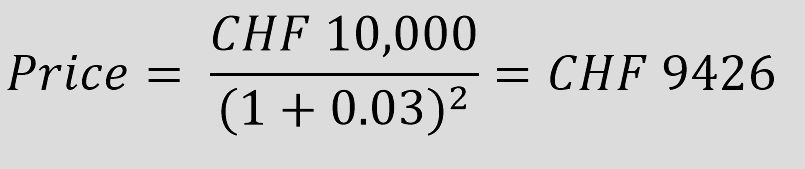

If an investor aims to achieve a yield of 3% for a bond with a face value of CHF 10,000 maturing in 2 years, they can calculate the price they would be willing to pay at most for a zero-coupon bond.

Advantages and Disadvantages of Zero-Coupon Bond

An advantage for the investor is that during the term, no taxes need to be paid as no coupons are distributed, thereby exempting any taxation on profits. This reduces administrative burdens and eliminates reinvestment risks as the coupon profits need not be reinvested, mitigating potential interest rate declines. Zero-coupon bonds also benefit from compound interest effects, particularly during periods of falling interest rates. Additionally, the yield is known at the start of the term, aiding easier future planning. These bonds can generally be sold during their term.

However, zero-coupon bonds come with

disadvantages. The entire

investment is tied up for the duration, limiting liquidity. In times of rising interest rates, receiving coupons for reinvestment might be advantageous. With the typically long duration and no interim payments, there's an

increased risk of issuer default. Moreover, these bonds experience high price fluctuations as the entire payment occurs at maturity, leading to high volatility and increased sensitivity to market changes. This heightened interest sensitivity could pose challenges if an investor cannot hold the investment until maturity and market interest rates rise.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.