What is the New York Stock Exchange (NYSE)?

The New York Stock Exchange (NYSE) is one of the largest stock exchanges in the world. On March 8, 2006, the previously private New York Stock Exchange became a public institution with the takeover of the Iceland Electronic Stock Exchange. In 2007, it merged with Euronext, Europe’s largest stock exchange, to form NYSE Euronext, later known as the Intercontinental Exchange (ICE), the current parent company of the New York Stock Exchange.

A look behind the scenes of the New York Stock Exchange

Source: untappedcities.com

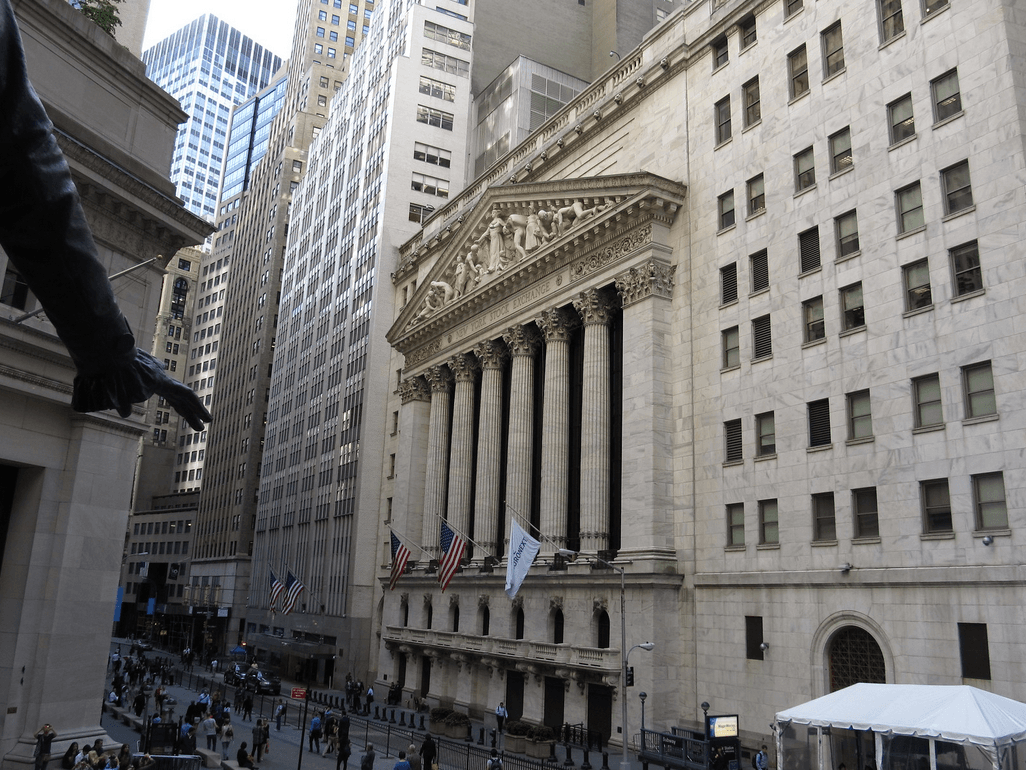

The NYSE, also known as the “Big Board”, is located on Wall Street in New York City and consists of a trading floor for stocks and another trading floor for the AmericanOptions Exchange NYSE. The main building at 18 Broad St. and the main building at 11 Wall St. were landmarked in 1987. The NYSE is the world’s largest stock exchange by market capitalization, estimated at $26.64 trillion in August 2021.

Main Entrance NYSE 18 Broad Street, Manhattan, New York

Source: flickr.com

NYSE entrance, 11 Wall Street, Manhattan, New York

Source: flickr.com

Trading on the NYSE

All transactions on the New York Stock Exchange take place in a continuous auction process. Brokers trade stocks while buyers and sellers auction securities for the best price. Although the NYSE is known for its floor trading, most stock transactions are now conducted electronically, with computers matching buyers and sellers (see also supply anddemand).

Although most transactions are now processed via electronic platforms, the NYSE is still a hybrid market. This allows brokers to send their orders either via the electronic platform or to the floor, where the orders are executed by floor traders.

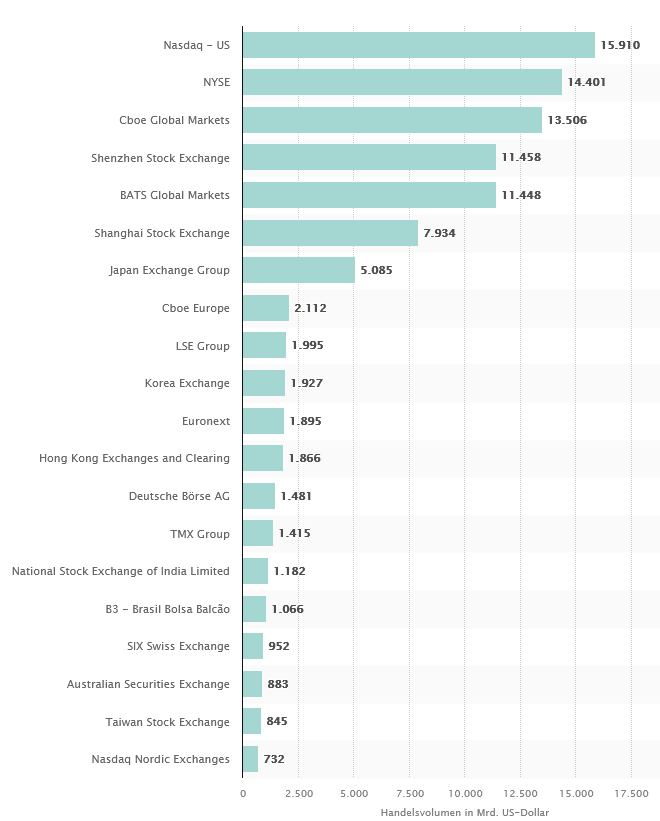

From January to December 2019, the NYSE was one of the three largest stock exchanges in the world in terms of share trading volume:

Trading volume in shares January-December 2019

Quelle: www.statista.com

The famous opening and closing bells of the NYSE

Originally, the NYSE used a gong to signal the start and end of trading, but in 1870 it switched to a Chinese gong. When it moved to its current location, the gong was replaced by a brass bell. The opening bell rings at 9:30 am Eastern Time, while the closing bell is heard at 4:00 pm.

The opening and closing bells are an important part of the Exchange ‘s branding and are also used to mark a financial-related event, or to celebrate an important event in New York City. It is an honor to be invited to ring the NYSE bell. Many who are asked to ring the bell are business executives, but there are also many celebrities who have rung the bell. This privilege was also given to the New York City Police and Fire Departments who answered the call of duty during the September 11, 2001 attacks.

Currently, the NYSE is open for trading Monday through Friday from 9:30 a.m. to 4:00 p.m. ET. The exchange is closed on certain US holidays. When these fall on a Saturday, the NYSE sometimes closes the Friday before. If the holiday falls on a Sunday, the NYSE may close on the following Monday.

History of the New York Stock Exchange

In 1792, the NYSE was founded at 68 Wall Street, where 24 brokers and merchants laid down the rules for securities trading in the Buttonwood Agreement. The organization was initially called the New York Stock & Exchange Board. In 1817, it was officially founded as the New York Stock and Exchange Board. The current name was adopted in 1863. At that time, only male traders participated in the NYSE. It was not until 1967 that a female trader named Muriel Siebert was allowed to participate in trading.

In 1971, the NYSE became a not-for-profit corporation and in 2006 became a publicly traded company. During this time, traders and the public began using an electronic system for trading stocks. In 2007, the NYSE merged with Euronext, and in 2008, the NYSE acquired the American Stock Exchange. Later, the Intercontinental Exchange bought the NYSE for 8.2 billion dollars.

A few notable dates in the history of the NYSE:

- October 24, 1929: The most devastating stock market crash in the history of the USA began on Black Thursday and continued on Black Tuesday, October 29, in a selling panic. It heralded the beginning of the global economic crisis, which affected all Western industrialized nations after the collapse of the London Stock Exchange in September.

- October 1, 1934: The NYSE is registered as a national securities exchange with the SEC.

- October 19, 1987: The Dow Jones Industrial Average (DJIA) falls by 508 points in a single day, which corresponds to a loss of 22.6 %.

- September 11, 2001: After the September 11 attacks, trading on the NYSE was suspended for four days and resumed on September 17. Around 1.4 trillion US dollars were lost in five trading days after the reopening. This is the largest loss in the history of the New York Stock Exchange.

- October 2008: NYSE Euronext completes the acquisition of the American Stock Exchange for 260 million dollars in shares.

- May 6, 2010: The DJIA suffers its biggest one-day drop since the crash of October 19, 1987, falling 998 points in what is known as the Flash Crash of 2010.

- December 20, 2012: ICE proposed to buy NYSE Euronext in a share swap worth $8 billion.

- May 1, 2014: The NYSE is fined $4.5 million by the Securities and Exchange Commission to settle allegations of violating market rules.

- May 25, 2018: Stacey Cunningham becomes the first female president of the NYSE.

- March 16, 2020: The emerging fear of a COVID-19 pandemic led to the DJIA recording its biggest daily loss in history, falling 2,997.10 points from its previous close. In percentage terms, this was the third worst day ever.

- March 23, 2020: The NYSE temporarily closes floor trading due to the COVID-19 pandemic and resumes operations electronically.

- March 24, 2020: The DJIA records its biggest daily gain on expectations of an economic stimulus package. In percentage terms, it was the fifth-best day ever.