Zombie Company

Would you like to invest your money? Get in touch with an expert:

What are Zombie Companies?

Zombie companies refer to businesses that can cover their interest payments but lack sufficient financial resources to repay their debts. Often, these entities manage interest or sometimes even repayments using new loans. Essentially, these companies just get by, handling expenses like wages, rent, and interest payments, but they lack sufficient funds for investment, thus impeding their growth potential. The risk lies in the potential insolvency these companies face due to unexpected events. Given their precarious position, investing in these entities is seen as risky, leading to a decline in their stock prices.

A company may become a zombie company when, for instance, it borrows money to make an investment that doesn't yield the expected returns. This could happen if

sales aren't realized due to unforeseen market changes or if costs rise unexpectedly, leaving insufficient revenue to cover expenses or the repayments on the loan. In such cases, attempts to avert insolvency are made by securing additional loans.

Zombie Companies – The Concept

The term 'zombie companies' emerged concerning businesses in Japan during the 'lost decade' of the 1990s following the burst of the asset price bubble. Many companies relied on banks for survival. Some economists argue that companies doomed to fail should not be rescued. While jobs might be retained, it dampens the growth of successful enterprises, thereby hindering the creation of new jobs. In 2008, the term 'zombies' resurfaced in reference to companies rescued by the government. During the financial crisis, several financial institutions were considered zombie companies, yet these firms had a substantial number of employees and were thus deemed 'too big to fail,' categorized as systemically important.

Zombie Companies and the Low-Interest Rate Policy

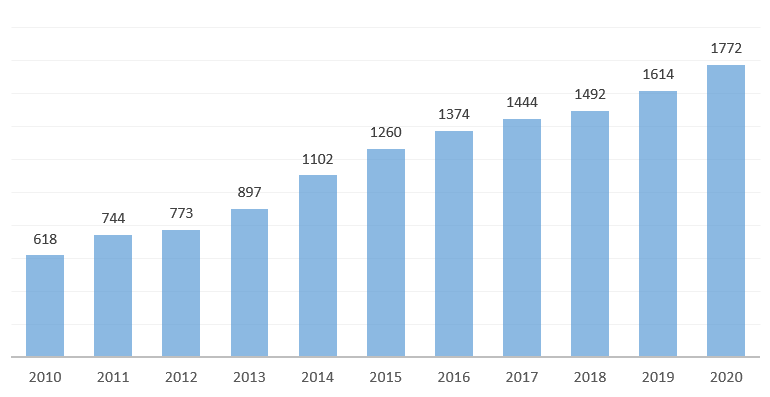

In recent years, monetary policies characterized by high debt and low interest rates have significantly contributed to the rise in the number of zombie companies, as depicted in the graph. This low-interest rate policy is often referred to as 'zombification.' Globally, the count surged from 618 zombie firms in 2010 to 1772 by 2020, and analysts anticipate a further increase due to the ongoing pandemic crisis.

Currently, central banks are raising interest rates to combat inflation. This could pose a significant challenge for existing zombie companies unable to meet their loan interest obligations. Moreover, some companies utilized the favorable loans for stock buybacks, boosting their stock prices instead of making productive investments—airlines in the years preceding the corona pandemic serve as an example.

Analysts have diverse opinions on how a wave of bankruptcies among these firms might affect the economy. Some argue that zombie companies tie up resources and skilled workers that could be more effectively employed elsewhere. In times of inflation, laid-off individuals might find alternative employment more readily. The situation could worsen if these companies go bankrupt during a recession. Conversely, others suggest that a wave of zombie company bankruptcies could lead to a recession.

Global Count of Listed Zombie Companies Over Time (2010-2020)

Source: Kearney Analysis https://www.kearney.com/

Investing in Zombie Companies

Investing in zombie companies carries a high level of risk. It is similar to an all-or-nothing scenario. Consider a small company putting all its financial resources into a specific product, hoping for its breakthrough success. If it fails, the company becomes insolvent, resulting in the investor losing their investment. If the product succeeds, the company might prove to be a good investment. However, this scenario is uncommon in practice. Only rarely do companies recover from such situations. ExxonMobil, operating in the energy sector, serves as an example. The company became a zombie firm due to the COVID-19 pandemic. However, given the current market environment with rising oil prices, influenced by the Ukraine conflict, the company has rebounded.

For investors with a high-risk tolerance inclined toward speculative investments, zombie companies might present an opportunity. Nevertheless, due to the elevated risk, seeking advice from a professional, such as a reputable wealth manager, could be beneficial.

Would you like to invest your money?

Speak to an expert.

Your first appointment is free of charge.