What is the return on assets (ROA)?

The return on assets (ROA) indicates how profitable a company is in relation to its total assets. ROA allows management, analysts and investors to determine whether a company is using its assets efficiently to generate profits. ROA indicates the return generated on invested capital or assets. A higher ROA means that a company is managing its balance sheet more efficiently and productively. This means that the company can earn more money with a smaller investment. ROA is calculated by dividing net profit by total assets. ROA takes into account a company’s debt, whereas return on equity (ROE) only takes into account equity, but not debt.

In order to compare ROAs of different companies, the sector should be taken into account, as is the case with many key figures. The ROA of a technology company is not necessarily the same as the ROA of a food and beverage company. It therefore makes more sense to compare the current ROA with the ROA of past periods of the same company or the ROA of similar companies.

Investors can use the ROA to find shares that appear attractive for an investment. An ROA that is continuously increasing indicates that the company can increase profits with every unit of money invested. A falling ROA, on the other hand, can mean that a company has invested too much in assets that do not show earnings growth or are not profitable. It is therefore a key figure that allows conclusions to be drawn about how efficiently a company uses its total assets.

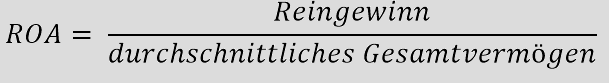

The calculation of the return on assets (ROA)

ROA is calculated by dividing the net profit of a company by its total assets. Total assets are the sum of total liabilities and equity. Both types of financing are used to fund a company’s operations. Since a company’s total assets can change over time due to the purchase or sale of vehicles, land, equipment, inventory changes or seasonal sales fluctuations, the average total assets are used to calculate ROA.

Example calculation of ROA

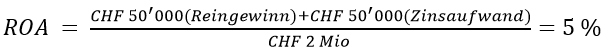

Assume a company in the real estatesector has only one rented property on the assets side of its balance sheet. This property has a value of CHF 2 million. The company consists of 50% equity (CHF 1 million) and 50% debt (CHF 1 million). The debt capital is a loan for which 5% interest must be paid annually. As the interest has to be paid, the company’s profit is reduced. The rental income amounts to CHF 100,000 per year. Other costs such as taxes and depreciation are not taken into account in this example. The annual profit is therefore CHF 100,000 minus the expenses for the loan of CHF 50,000. However, the interest expense must be added back to the annual profit for the calculation to be correct.

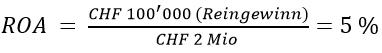

The return on equity (ROE ) changes through the use of borrowed capital. This is also known as the leverage effect. However, the ROA remains unchanged. Assuming the company is only financed with equity (i.e. CHF 2 million), the ROA is also 5%.

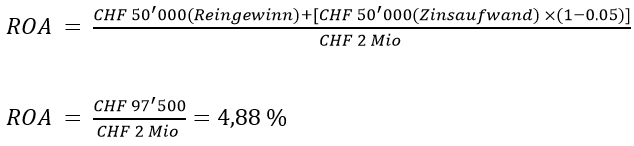

However, it should be noted that taxes are not taken into account in this example. Interest on borrowed capital is an expense and reduces profit, but reduces the tax burden (tax shield). The total capital ratio can therefore vary, as the profit can change when taxes are taken into account. Assuming that taxes also amount to 5%, the calculation is as follows.

The disadvantages of ROA

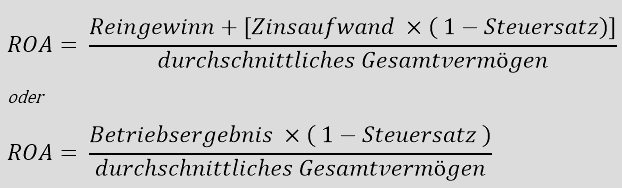

One weakness already mentioned is that the ROA of companies cannot be compared across industries. Different companies in different industries have a different composition of total assets. Some analysts are of the opinion that ROA is not a good indicator for all companies. For banks, for example, ROA works very well because the balance sheets represent the real value of their assets and liabilities. For other companies, however, it makes more sense to look at debt and equity separately. The interest expense is the return for the lender, while the net profit is the return for the equity providers. Therefore, it does not make sense to compare the net profit, i.e. the return for equity providers, with the assets financed by debt and equity providers (total assets). For this reason, the following variant is often used to calculate the ROA:

This means that the positive tax effect or the so-called “tax shield” is also taken into account, as the interest expense can be claimed for tax purposes.